United States federal government credit-rating downgrades

The downgrade to AA+ occurred four days after the 112th United States Congress voted to raise the debt ceiling of the federal government by means of the Budget Control Act of 2011 on August 2, 2011.

S&P announced on August 23, 2011, that Deven Sharma would step down as a Chief of Standard & Poor's effective September 12, 2011, and would leave the company by end of the year.

The downgrade was criticized by the U.S. Treasury Department,[2] both Democratic[3][4] and Republican Party[5][6] political figures, and many business people and economists.

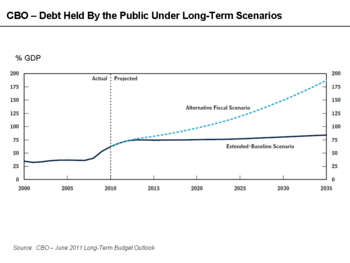

In the short-run, tax revenues have declined significantly due to a severe recession and tax-policy choices, while expenditures have expanded for wars, unemployment insurance and other safety net spending.

[15][16] In the long-run, expenditures related to healthcare programs such as Medicare and Medicaid are growing considerably faster than the economy overall as the population matures.

[22] On August 5, 2011, representatives from S&P announced the company's decision to give its first-ever downgrade to U.S. sovereign debt, lowering the rating one notch to "AA+", with a negative outlook.

[23][24] S&P was direct in its criticism of the governance and policy-making process, which took the U.S. to the brink of default as part of the 2011 U.S. debt-ceiling crisis that same week: S&P revised the revenue assumptions underlying one of their future debt-level projections: The report specifically refused to take a position on the blend of policy choices necessary to improve or maintain the credit rating: Both Democratic and Republican politicians criticized S&P's decision, as well as placing blame with the other party.

[26] Almost immediately after S&P announced the downgrade, first reported after 8 p.m.[27] on a Friday night, Obama administration officials began to publicly criticize S&P's decision.

[7][8][9][10] According to Mike Allen's Politico Playbook, "As a result of an error in constructing discretionary spending levels underlying the analysis, the deficit was $2 trillion higher over 10 years than the Congressional Budget Office would estimate.

However, U.S. treasury bonds, which had been the subject of the downgrade, actually rose in price and the dollar gained in value against the Euro and the British pound, indicating a general flight to safe assets amid concerns about a European debt crisis.

[37] In response to the 2023 United States debt-ceiling crisis, Fitch placed its AAA rating on a negative watch on May 24, 2023, warning that "risks have risen that the debt limit will not be raised or suspended before the x-date and consequently that the government could begin to miss payments on some of its obligations."

"[42] Two years later in 2013, S&P "blasted a $5 billion fraud lawsuit by the U.S. government as retaliation for its 2011 decision to strip the country of its AAA credit rating.

"[43] Two weeks after the second downgrade by Egan-Jones in April 2012 to AA, the SEC voted to bring administrative action against the firm regarding years-old activity.