Value-added tax

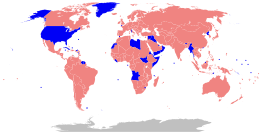

VAT raises about a fifth of total tax revenues worldwide and among the members of the Organisation for Economic Co-operation and Development (OECD).

[1]: 14 As of June 2023, 175[2] of the 193 countries with UN membership employ a VAT, including all OECD members except the United States.

[5]Following creation of the European Economic Community in 1957, the Fiscal and Financial Committee set up by the European Commission in 1960 under the chairmanship of Professor Fritz Neumark made its priority objective the elimination of distortions to competition caused by disparities in national indirect tax systems.

[6][7] The Neumark Report published in 1962 concluded that France's VAT model would be the simplest and most effective indirect tax system.

The main benefits of VAT are that in relation to many other forms of taxation, it does not distort firms' production decisions, it is difficult to evade, and it generates a substantial amount of revenue.

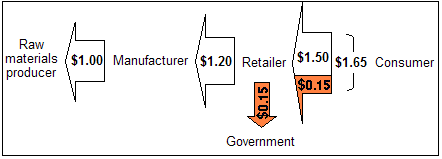

[14] VAT has no effect on how businesses organize, because the same amount of tax is collected regardless of how many times goods change hands before arriving at the ultimate consumer.

[15] 10% sales tax: So, the consumer pays 10% ($0.15) extra, compared to the no taxation scheme, and the government collects this amount.

Suppliers and manufacturers have the administrative burden of supplying correct state exemption certifications that the retailer must verify and maintain.

[16] Defenders reply that relating taxation levels to income is an arbitrary standard and that the VAT is in fact a proportional tax.

[20] VAT offers distinctive opportunities for evasion and fraud, especially through abuse of the credit and refund mechanism.

Advertised and posted prices generally exclude taxes, which are calculated at the time of payment; common exceptions are motor fuels, the posted prices for which include sales and excise taxes, and items in vending machines as well as alcohol in monopoly stores.

Other provinces that do not have a HST may have a Provincial Sales Tax (PST), which are collected in British Columbia (7%), Manitoba (7%) and Saskatchewan (6%).

AS of 2023, the VAT tax includes majority of services excluding Education, Health and Transport, as well as taxpayers issuing fee receipts.

Some EU members have a 0% VAT rate on certain items; these states agreed this as part of their accession (for example, newspapers and certain magazines in Belgium).

Under the BJP government, it was replaced by a national Goods and Services Tax according to the One Hundred and First Amendment of the Constitution of India.

Per 1 April 2022, maximum a Goods and Services Tax (GST) is levied at the rate of 11% at point of sales.

The first reduced VAT rate (10 percent) applies to water supplies, passenger transport, admission to cultural and sports events, hotels, restaurants and some foodstuff.

The super-reduced VAT rate (4 percent) applies to TV licenses, newspapers, periodicals, books and medical equipment for the disabled.

[67][68] Multinational companies that provide services to Israel through the Internet, such as Google and Facebook, must pay VAT.

Many domestically consumed items such as fresh foods, water and electricity are zero-rated, while some supplies such as education and health services are GST exempted.

GST in New Zealand is designed to be a broad-based system with few exemptions, such as for rents collected on residential rental properties, donations, precious metals and financial services.

Services such as public transport, health care, newspapers, rent (the lessor can voluntarily register as a VAT payer, except for residential premises), and travel agencies.

An 11% rate is applied for hotel and guesthouse stays, licence fees for radio stations (namely RÚV), newspapers and magazines, books; hot water, electricity and oil for heating houses, food for human consumption (but not alcoholic beverages), access to toll roads and music.

[79] In Norway, the general rate is 25%, 15% on foodstuffs, and 12% on hotels and holiday homes, on some transport services, cinemas.

MOMS replaced OMS (Danish omsætningsafgift, Swedish omsättningsskatt) in 1967, which was a tax applied exclusively for retailers.

VAT payers include organizations (industrial and financial, state and municipal enterprises, institutions, business partnerships, insurance companies and banks), enterprises with foreign investments, individual entrepreneurs, international associations, and foreign entities with operations in the Russian Federation, non-commercial organizations that conduct commercial activities, and those who move goods across the border of the Customs Union.

[91] The party providing the service or delivering the goods is liable for the payment of the VAT, but the tax is usually passed on to the customer as part of the price.

Registration is required (for residents and non-residents) if value of taxable supplies of goods or services exceeds ₴1 million during any 12-month period.

A legal entity may apply for voluntary registration if it has no VATable activities or if the volume The United Kingdom introduced VAT in 1973 after joining the EEC.

[102] Former 2020 Democratic presidential candidate Andrew Yang advocated for a national VAT in order to pay for his universal basic income proposal.