The Vanguard Group

The Vanguard Group, Inc. is an American registered investment advisor founded on May 1, 1975, and based in Malvern, Pennsylvania, with about $10.4 trillion in global assets under management as of November 2024.

[5] Along with BlackRock and State Street, Vanguard is considered to be one of the Big Three index fund managers that play a dominant role in retail investing.

It has satellite offices in Charlotte, North Carolina, Dallas, Texas, Washington D.C., and Scottsdale, Arizona, as well as Canada, Australia, Asia, and Europe.

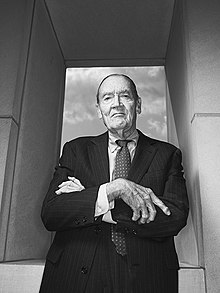

In 1951, for his undergraduate thesis at Princeton University, John C. Bogle conducted a study in which he found that most mutual funds did not earn more money compared to broad stock market indexes.

[15] Bogle has said about being fired: "The great thing about that mistake, which was shameful and inexcusable and a reflection of immaturity and confidence beyond what the facts justified, was that I learned a lot.

[17] Bogle chose this name after a dealer in antique prints left him a book about Great Britain's naval achievements that featured HMS Vanguard.

[8][9] Bogle was also inspired by Paul Samuelson, an economist who later won the Nobel Memorial Prize in Economic Sciences, who wrote in an August 1976 column in Newsweek that retail investors needed an opportunity to invest in stock market indexes such as the S&P 500.

[20] This was one of the earliest passive investing index funds, preceded a few years earlier by a handful of others (e.g., Jeremy Grantham's Batterymarch Financial Management in Boston, and index funds managed by Rex Sinquefield at American National Bank in Chicago, and John "Mac" McQuown at Wells Fargo's San Francisco office).

[27] In March 2021, Vanguard joined over 70 asset managers, aiming to have companies within their portfolios to achieve net-zero emissions by 2060, a goal that parallels the Paris Agreement.

[28] Climate and Indigenous advocates felt optimistic about this development, but stressed the issue that Vanguard must also stop investing in companies that engage in deforestation, fossil fuel extraction, and environmental degradation.

In line with their sustainability efforts, Vanguard has put out a number of statements aimed at tackling climate change within their portfolios and the world at large.

[30] In terms of financial involvement, today, Vanguard holds at least $86 billion in coal,[31] making them the world's number-one investor in the industry.

He believed buy and hold investors could make good use of ETFs tracking broad indices, but thought ETFs had potentially higher fees due to the bid ask spread, could be too narrowly specialized, and worried anything that could be traded mid-day would be traded mid-day, potentially reducing investor returns.

[41] In October 2020, Vanguard returned about $21 billion in managed assets to government clients in China due to concerns about legal compliance, staffing and profitability.