Vehicle Excise Duty

[4] VED across the United Kingdom is collected and enforced by the Driver and Vehicle Licensing Agency (DVLA).

Until 2014, VED in Northern Ireland was collected by the Driver and Vehicle Agency there; responsibility has since been transferred to the DVLA.

The price structure was revised from 1 April 2013 to introduce an alternative charge for the first year (the standard cost was not changed, and remained the same as for 2001 onwards).

[12] At first the supplement applied to all types of car, but the 2020 Budget provided an exemption for zero-emission vehicles (both new and existing), effective from 1 April 2020.

[19] The HGV levy was suspended from 1 August 2020 to 31 July 2023 to support the haulage sector and aid pandemic recovery efforts.

[23] As of 1 April 2014, vehicles manufactured before 1 January 1974 became exempt from the VED (Finance Act 2014, as set out in the 2013 Budget, 20 March 2013).

[26] Automatic number plate recognition (ANPR) systems are being used to identify untaxed, uninsured vehicles and stolen cars.

The Finance Act 1920 introduced a "Duty on licences for mechanically propelled vehicles" which was to be hypothecated – that is, the revenue would be exclusively dedicated to a particular expenditure, namely the newly established Road Fund.

"[37] Hypothecation came to an end in 1937 under the 1936 Finance Act, and the proceeds of the vehicle road taxes were paid directly into the Exchequer.

[33] Since 1998, keepers of registered vehicles which had been licensed since 1998, but which were not currently using the public roads, have been required to submit an annual Statutory Off-Road Notification (SORN).

Among the proposals was a suggestion that VED could be replaced by increased fuel duty as an incentive for consumers to purchase vehicles with lower emission ratings.

The proposal was politically unappealing, as it would increase costs for businesses and for people living in rural areas.

[4] In the pre-budget report of 27 November 2001 the Government announced that VED for HGVs could be replaced, by a new tax based on distance travelled, the Lorry Road-User Charge (LRUC).

In an attempt to reduce this, from 2004 an automatic £80 penalty (halved if paid within 28 days) is issued by the DVLA computer for failure to pay the tax within one month of expiry.

The idea raised objections on civil and human rights grounds that it would amount to mass surveillance.

An online petition protesting this was started and reached over 1.8 million signatures by the closing date of 20 February 2007.

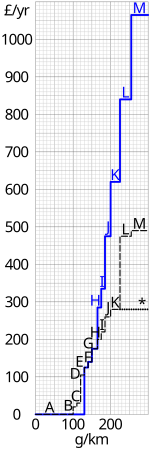

In April 2009 there was a reclassification to the CO2 rating based bandings with the highest set at £455 per year and the lowest at £0; the bandings have also been backdated to cover vehicles registered on or after 1 March 2001, meaning that vehicles with the highest emissions ratings registered after this date pay the most.

In 2009 a consultation document from the Scottish Government raised the possibility of a VED on all road users including cyclists, but there was a strong consensus against this.