Distribution of wealth

For example, the United Nations definition of inclusive wealth is a monetary measure which includes the sum of natural, human and physical assets.

This is P99/P50 is one of the potential Kuznets ratios which is the inverted U shape that indicates the relationship between the inequality and the income per capita.

It is a straight line from the leftmost (maximum wealth) point horizontally across the people scale to p=99.

In fact it is a comparison to a diagonal society that is the basis for the Gini values used as a measure of the disequity in a particular economy.

These Gini values (40.8 in 2007) show the United States to be the third most dis-equitable economy of all the developed nations (behind Denmark and Switzerland).

There was also reason to believe that the inequality in wealth was shrinking over time, and also the distribution's shape demonstrated particular statistical regularities that could not have been caused by coincidence.

Another important progress has been the increase in availability and finesse in sets of micro-data, which offer not just estimations of individuals' asset holdings and savings but also a variety of other household and personal characteristics that can assist in explain the differences in wealth.

Although most research depends on written sources, archaeologists and anthropologists often view large houses as occupied by wealthy households.

[8] The distribution of contemporaneous house sizes in a society (perhaps analyzed using the Gini coefficient) then can regarded as a measure of wealth inequality.

This approach has been used at least since 2014[9] and has shown, for example, that ancient wealth disparities in Eurasia were greater than those in North America and in Mesoamerica following the earliest Neolithic period.

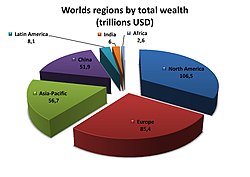

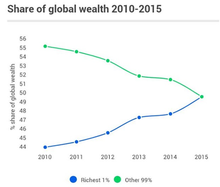

In conclusion, this comparison shows a substantial worldwide increase in wealth inequality over these years.

Credit Suisse claims that the economic impact of the pandemic on employment and incomes in 2020 are likely to have a negative effect for the lowest groups of wealth holders, forcing them to spend more from their savings or incur higher debt.

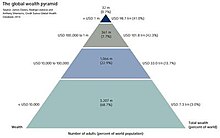

Personal assets were calculated in net worth, meaning wealth would be negated by having any mortgages.

[12] It has a large base of low wealth holders, alongside upper tiers occupied by progressively fewer people.

While the average wealth holding is modest in the base and middle segments of the pyramid, their total wealth amounts to US$40 trillion, underlining the potential for novel consumer products and innovative financial services targeted at this often neglected segment.

Credit Suisse explains in the ‘Global Wealth Report 2021’, that this increase reflects the economic disruption caused by the pandemic and disconnect between the improvement in the financial and real assets of households.

According to Credit Suisse, the number of adults in this segment tripled since 2000. Credit Suisse explains this fact by stating that this increase was a result of growing prosperity of emerging economies, especially China, and the expansion of the middle class in the developing world.

Credit Suisse in the report states that the middle class in developed countries typically belong to this group.

The bottom segment covering adults with a net worth below USD 10,000 will likely decrease by approximately 108 million over the next five years.

When compared to the report made by Credit Suisse in 2019, an increasing trend of wealth inequality can be observed.

[36][37] In September 2012, according to the Institute for Policy Studies, "over 60 percent" of the Forbes richest 400 Americans "grew up in substantial privilege".

[40][24][39] Dan Ariely and Michael Norton show in a study (2011) that US citizens across the political spectrum significantly underestimate the current US wealth inequality and would prefer a more egalitarian distribution of wealth, raising questions about ideological disputes over issues like taxation and welfare.

[36][37] In September 2012, according to the Institute for Policy Studies, "over 60 percent" of the Forbes 400 Richest Americans "grew up in substantial privilege".

[44] Joseph E. Fargione, Clarence Lehman and Stephen Polasky demonstrated in 2011 that chance alone, combined with the deterministic effects of compounding returns, can lead to unlimited concentration of wealth, such that the percentage of all wealth owned by a few entrepreneurs eventually approaches 100%.

In the case of plutocracy, the wealthy exert power over the legislative process, which enables them to increase the wealth disparity.

Because these mechanisms are non-exclusive, it is possible for all three explanations to work together for a compounding effect, increasing wealth concentration even further.

Obstacles to restoring wage growth might have more to do with the broader dysfunction of a dollar dominated political system particular to the US than with the role of the extremely wealthy.

Examples of this practice go back at least to the Roman Republic in the third century B.C.,[55] when laws were passed limiting the amount of wealth or land that could be owned by any one family.

[59] While the ideas of Marx have nominally influenced various states in the 20th century, the Marxist notions of socialism and communism remains elusive.

[61] In the Outlook on the Global Agenda 2014 from the World Economic Forum the widening income disparities come second as a worldwide risk.