World currency

[3] Spain's political supremacy on the world stage, the importance of Spanish commercial routes across the Atlantic and the Pacific, and the coin's quality and purity of silver helped it become internationally accepted for about three centuries.

It was legal tender in Spain's Pacific territories of Philippines, Guam and Micronesia, and later in China and other Southeast Asian countries, until the mid-19th century.

In Europe it was legal tender in the Iberian Peninsula, as well as most of Italy including Milan, the Kingdom of Naples, Sicily and Sardinia; in the Franche-Comté (France); and in the Spanish Netherlands.

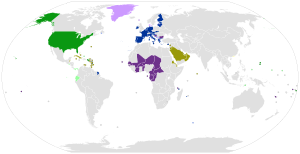

Other European countries, while not being EU members, have adopted the euro due to currency unions with member states, or by unilaterally superseding their own currencies: Andorra, Monaco, Kosovo, Montenegro, San Marino, and Vatican City.

[9] On 23 March 2009, Zhou Xiaochuan, then-President of the People's Bank of China, called for a replacement of the US dollar with a different standard using "creative reform of the existing international monetary system towards an international reserve currency," believing it would "significantly reduce the risks of a future crisis and enhance crisis management capability.

"[14] At the G8 summit in July 2009, Dmitry Medvedev expressed Russia's desire for a new supranational reserve currency by showing off a coin minted with the words "unity in diversity".

[15] On 30 March 2009, at the second South America-Arab League Summit in Qatar, Venezuelan president Hugo Chavez proposed the creation of a petro-currency.

[17] An alternative definition of a world or global currency refers to a hypothetical single global currency or supercurrency, as the proposed terra or the DEY (acronym for Dollar Euro Yen),[18] produced and supported by a central bank which is used for all transactions around the world, regardless of the nationality of the entities (individuals, corporations, governments, or other organizations) involved in the transaction.

In addition, many[20] argue that a single global currency would make conducting international business more efficient and would encourage foreign direct investment (FDI).

[21] Supporters often point to the euro as an example of a supranational currency successfully implemented by a union of nations with disparate languages, cultures, and economies.

On 26 March 2009, a UN panel of expert economists called for a new global currency reserve scheme to replace the current US dollar-based system.

The panel's report pointed out that the "greatly expanded SDR (special drawing rights), with regular or cyclically adjusted emissions calibrated to the size of reserve accumulations, could contribute to global stability, economic strength and global equity.

As a result of the larger differences in wealth in different areas of the world, a central bank's ability to set interest rates to make the area prosper will be increasingly compromised, since it places wealthiest regions in conflict with the poorest regions in debt.