Great Recession

The causes of the Great Recession include a combination of vulnerabilities that developed in the financial system, along with a series of triggering events that began with the bursting of the United States housing bubble in 2005–2012.

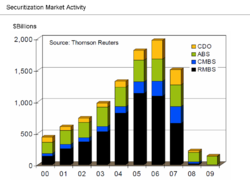

When housing prices fell and homeowners began to abandon their mortgages, the value of mortgage-backed securities held by investment banks declined in 2007–2008, causing several to collapse or be bailed out in September 2008.

The combination of banks being unable to provide funds to businesses, and homeowners paying down debt rather than borrowing and spending, resulted in the Great Recession that began in the U.S. officially in December 2007 and lasted until June 2009, thus extending over 19 months.

Two interpretations of the word "recession" exist: one sense referring definitively to "a period of reduced economic activity"[7] and ongoing hardship; and the more allegoric interpretation used in economics, which is defined operationally, referring specifically to the contraction phase of a business cycle, with two or more consecutive quarters of GDP contraction (negative GDP growth rate) and typically used to influence abrupt changes in monetary policy.

Economists advise that the stimulus measures such as quantitative easing (pumping money into the system) and holding down central bank wholesale lending interest rate should be withdrawn as soon as economies recover enough to "chart a path to sustainable growth".

In his separate dissent to the majority and minority opinions of the FCIC, Commissioner Peter J. Wallison of the American Enterprise Institute (AEI) primarily blamed U.S. housing policy, including the actions of Fannie and Freddie, for the crisis.

He wrote: "When the bubble began to deflate in mid-2007, the low quality and high risk loans engendered by government policies failed in unprecedented numbers.

At the same time, weak underwriting standards, unsound risk management practices, increasingly complex and opaque financial products, and consequent excessive leverage combined to create vulnerabilities in the system.

"[48] In May 2008, NPR explained in their Peabody Award winning program "The Giant Pool of Money" that a vast inflow of savings from developing nations flowed into the mortgage market, driving the U.S. housing bubble.

NPR explained this money came from various sources, "[b]ut the main headline is that all sorts of poor countries became kind of rich, making things like TVs and selling us oil.

[51] There is an argument that Greenspan's actions in the years 2002–2004 were actually motivated by the need to take the U.S. economy out of the early 2000s recession caused by the bursting of the dot-com bubble: although by doing so he did not avert the crisis, but only postponed it.

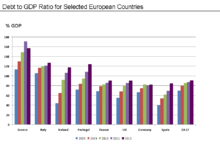

When house prices declined, ushering in the global financial crisis, many households saw their wealth shrink relative to their debt, and, with less income and more unemployment, found it harder to meet mortgage payments.

A 2009 paper identifies twelve economists and commentators who, between 2000 and 2006, predicted a recession based on the collapse of the then-booming housing market in the United States:[62] Dean Baker, Wynne Godley, Fred Harrison, Michael Hudson, Eric Janszen, Med Jones[63] Steve Keen, Jakob Brøchner Madsen, Jens Kjaer Sørensen, Kurt Richebächer, Nouriel Roubini, Peter Schiff, and Robert Shiller.

[33] The hypothesis that a primary cause of the crisis was U.S. government housing policy requiring banks to make risky loans has been widely disputed,[86] with Paul Krugman referring to it as "imaginary history".

For example, Ravi Batra argues that growing inequality of financial capitalism produces speculative bubbles that burst and result in depression and major political changes.

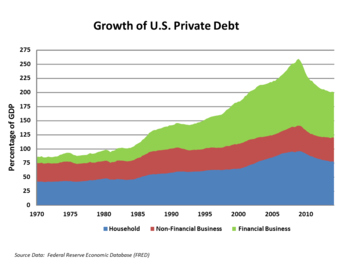

[96] A key dynamic slowing the recovery was that both individuals and businesses paid down debts for several years, as opposed to borrowing and spending or investing as had historically been the case.

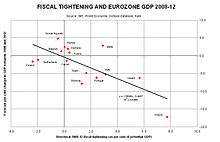

[109] Economist Martin Wolf analysed the relationship between cumulative GDP growth from 2008 to 2012 and total reduction in budget deficits due to austerity policies (see chart) in several European countries during April 2012.

[110] Economist Paul Krugman analysed the relationship between GDP and reduction in budget deficits for several European countries in April 2012 and concluded that austerity was slowing growth, similar to Martin Wolf.

[120][121][122] Analysts identified several causes for the positive economic development in Poland: Extremely low levels of bank lending and a relatively small mortgage market; the relatively recent dismantling of EU trade barriers and the resulting surge in demand for Polish goods since 2004; Poland being the recipient of direct EU funding since 2004; lack of over-dependence on a single export sector; a tradition of government fiscal responsibility; a relatively large internal market; the free-floating Polish zloty; low labour costs attracting continued foreign direct investment; economic difficulties at the start of the decade, which prompted austerity measures in advance of the world crisis.

Subsequent follow-up recessions in 2010–2013 were confined to Belize, El Salvador, Paraguay, Jamaica, Japan, Taiwan, New Zealand and 24 out of 50 European countries (including Greece).

By mid-2012 Iceland is regarded as one of Europe's recovery success stories largely as a result of a currency devaluation that has effectively reduced wages by 50%--making exports more competitive.

[16] The following countries/territories had a recession starting in the second quarter of 2008: Japan,[133] Hong Kong,[134] Singapore,[135] Italy,[136] Turkey,[16] Germany,[137] United Kingdom,[16] the Eurozone,[138] the European Union,[16] and the OECD.

[153] NPR reports that David Gordon, a former intelligence officer who now leads research at the Eurasia Group, said: "Many, if not most, of the big countries out there have room to accommodate economic downturns without having large-scale political instability if we're in a recession of normal length.

[167][168] On February 17, 2009, U.S. President Barack Obama signed the American Recovery and Reinvestment Act of 2009, an $787 billion stimulus package with a broad spectrum of spending and tax cuts.

The stimulus package was invested in key areas such as housing, rural infrastructure, transportation, health and education, environment, industry, disaster rebuilding, income-building, tax cuts, and finance.

On November 28, 2008, the Ministry of Finance of the People's Republic of China and the State Administration of Taxation jointly announced a rise in export tax rebate rates on some labour-intensive goods.

[citation needed] In early December 2008, German Finance Minister Peer Steinbrück indicated a lack of belief in a "Great Rescue Plan" and reluctance to spend more money addressing the crisis.

The IMF urged governments to expand social safety nets and to generate job creation even as they are under pressure to cut spending.

On April 17, 2009, the then head of the IMF Dominique Strauss-Kahn said that there was a chance that certain countries may not implement the proper policies to avoid feedback mechanisms that could eventually turn the recession into a depression.

[189] Olivier Blanchard, IMF Chief Economist, stated that the percentage of workers laid off for long stints has been rising with each downturn for decades but the figures have surged this time.

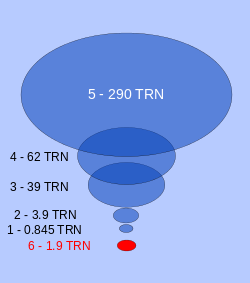

1. Central banks' gold reserves: $0.845 trillion

2. M0 (paper money): $3.9 trillion

3. Traditional (fractional reserve) banking assets: $39 trillion

4. Shadow banking assets: $62 trillion

5. Other assets: $290 trillion

6. Bail-out money (early 2009): $1.9 trillion