Actuary

The steps needed to become an actuary, including education and licensing, are specific to a given country, with various additional requirements applied by regional administrative units; however, almost all processes impart universal principles of risk assessment, statistical analysis, and risk mitigation, involving rigorously structured training and examination schedules, taking many years to complete.

For this reason, actuaries are essential to the insurance and reinsurance industries, either as staff employees or as consultants; to other businesses, including sponsors of pension plans; and to government agencies such as the Government Actuary's Department in the United Kingdom or the Social Security Administration in the United States of America.

Actuaries assemble and analyze data to estimate the probability and likely cost of the occurrence of an event such as death, sickness, injury, disability, or loss of property.

[18] In addition to these risks, social insurance programs are influenced by public opinion, politics, budget constraints, changing demographics, and other factors such as medical technology, inflation, and cost of living considerations.

[22] Actuaries are also involved in other areas in the economic and financial field, such as analyzing securities offerings or market research.

[18] On both the life and casualty sides, the classical function of actuaries is to calculate premiums and reserves for insurance policies covering various risks.

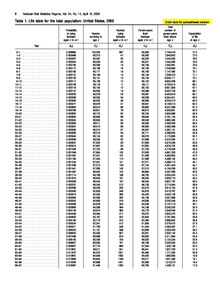

On the life side, the analysis often involves quantifying how much a potential sum of money or a financial liability will be worth at different points in the future.

Forecasting interest yields and currency movements also plays a role in determining future costs, especially on the life side.

Often, their work may relate to determining the cost of financial liabilities that have already occurred, called retrospective reinsurance,[25] or the development or re-pricing of new products.

Merchants embarking on trade journeys bore the risk of losing goods entrusted to them, their own possessions, or even their lives.

The primary providers in extended families or households ran the risk of premature death, disability or infirmity, which could leave their dependents to starve.

Alternatively, people sometimes lived too long from a financial perspective, exhausting their savings, if any, or becoming a burden on others in the extended family or society.

[34] Early methods of protection, aside from the normal support of the extended family, involved charity; religious organizations or neighbors would collect for the destitute and needy.

[34] Charitable protection remains an active form of support in the modern era,[35] but receiving charity is uncertain and often accompanied by social stigma.

[4] Other early examples of mutual surety and assurance pacts can be traced back to various forms of fellowship within the Saxon clans of England and their Germanic forebears, and to Celtic society.

[37] In 1350, Lenardo Cattaneo assumed "all risks from act of God, or of man, and from perils of the sea" that may occur to a shipment of wheat from Sicily to Tunis up to a maximum of 300 florins.

[7] In his work, Halley demonstrated a method of using his life table to calculate the premium someone of a given age should pay to purchase a life-annuity.

[39] Previously, the use of the term had been restricted to an official who recorded the decisions, or acts, of ecclesiastical courts, in ancient times originally the secretary of the Roman senate, responsible for compiling the Acta Senatus.

In the United States, the 1920 revision to workers' compensation rates took over two months of around-the-clock work by day and night teams of actuaries.

[48][49] In the late 1980s and early 1990s, there was a distinct effort for actuaries to combine financial theory and stochastic methods into their established models.

Actuaries work comparatively reasonable hours, in comfortable conditions, without the need for physical exertion that may lead to injury, are well paid, and the profession consistently has a good hiring outlook.

[10][13][14][15][16][17] Becoming a fully credentialed actuary requires passing a rigorous series of professional examinations, usually taking several years.

As a result, actuarial students have strong incentives for devoting adequate study time during off-work hours.

At times, they have been portrayed as "math-obsessed, socially disconnected individuals with shockingly bad comb-overs", which has resulted in a mixed response amongst actuaries themselves.