Life table

[2] Tables have been created by demographers including John Graunt, Reed and Merrell, Keyfitz, and Greville.

A cohort life table is more frequently used because it is able to make a prediction of any expected changes in the mortality rates of a population in the future.

[4] Other life tables in historical demography may be based on historical records, although these often undercount infants and understate infant mortality, on comparison with other regions with better records, and on mathematical adjustments for varying mortality levels and life expectancies at birth.

If a population were to have a constant number of people each year, it would mean that the probabilities of death from the life table were completely accurate.

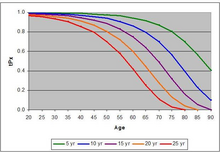

For these reasons, the older ages represented in a life table may have a greater chance of not being representative of what lives at these ages may experience in future, as it is predicated on current advances in medicine, public health, and safety standards that did not exist in the early years of this cohort.

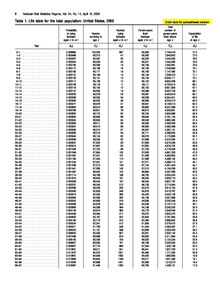

A life table is created by mortality rates and census figures from a certain population, ideally under a closed demographic system.

[9] The life table observes the mortality experience of a single generation, consisting of 100,000 births, at every age number they can live through.

[3] Life tables are usually constructed separately for men and for women because of their substantially different mortality rates.

The availability of computers and the proliferation of data gathering about individuals has made possible calculations that are more voluminous and intensive than those used in the past (i.e. they crunch more numbers) and it is more common to attempt to provide different tables for different uses, and to factor in a range of non-traditional behaviors (e.g. gambling, debt load) into specialized calculations utilized by some institutions for evaluating risk.

However the expression "life table" normally refers to human survival rates and is not relevant to non-life insurance.

This age may be the point at which life insurance benefits are paid to a survivor or annuity payments cease.

By watching over the life expectancy of any year(s) being studied, epidemiologists can see if diseases are contributing to the overall increase in mortality rates.

[13] Epidemiologists are able to help demographers understand the sudden decline of life expectancy by linking it to the health problems that are arising in certain populations.