Euronext Amsterdam

The registered office of Euronext, itself incorporated in the Netherlands a public limited company (naamloze vennootschap), is also located in the exchange.

The monopolistic terms of the charter effectively granted the VOC complete authority over trade defenses, war armaments, and political endeavors in Asia.

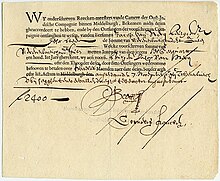

Following in the footsteps of the English East India Company, stock in the corporation was sold to a large pool of interested investors, who in turn received a guarantee of some future share of profits.

State loan stocks had been negotiable at a very early date in Venice, in Florence before 1328, and in Genoa, where there was an active market in the luoghi and paghe of Casa di San Giorgio, not to mention the Kuxen shares in the German mines which were quoted as early as the fifteenth century at the Leipzig fairs, the Spanish juros, the French rentes sur l'Hotel de Ville (municipal stocks) (1522) or the stock market in the Hanseatic towns from the fifteenth century.

Quickly a secondary market arose in the East India House for resale of this stock through the official bookkeeper.

[7] The official account, held by the East India House, encouraged investors to trade and gave rise to market confidence that the shares weren't just being transferred on paper.

However, at this time neither the VOC nor its shareholders saw a slowing down of Asian trade, so the States General of the Netherlands granted the corporation a second charter in the West Indies.

The system of privatizing national expeditions was not new to Europe, but the fixed stock structure of the East India Company made it one of a kind.

In the decade preceding the formation of the VOC, adventurous Dutch merchants had used a similar method of "private partnership" to finance expensive voyages to the East Indies for their personal gain.

[9] These Voorcompagnieën took on extreme risk to reap some of the rewarding spice trade in the East Indies, but introduced a common form of the joint-stock venture into Dutch shipping.

Shortly after these expeditions began, in 1602, the many independent Voorcompagnieën merged to form the Dutch East India Trading Company.

The VOC was granted significant war-time powers, the right to build forts, the right to maintain a standing army, and permission to conduct negotiations with Asian countries.

Quickly a secondary market arose in the East India House for resale of this stock through the official bookkeeper.

[7] The official account, held by the East India House, encouraged investors to trade and gave rise to market confidence that the shares weren't just being transferred on paper.

The rapid development of the Amsterdam Stock exchange in the mid 17th century led to the formation of trading clubs around the city.

[16] Rather than being a bazaar where goods were traded intermittently, exchanges had the advantage of being a regularly meeting market, which enabled traders to become more specialized and engage in more complicated transactions.

[2][4] As early as the middle of the sixteenth century, people in Amsterdam speculated in grain and, somewhat later, in herring, spices, whale-oil, and even tulips.

[22] While only a short amount of time for trading inside the building, the window created a flurry of investors that in turn made it easier for buyers to find sellers and vice versa.

Its proximity gave investors the luxury of walking a short distance to both register the transaction in the official books of the VOC, and complete the money transfer in the nearby Exchange Bank, also in Dam square.