Visa Inc.

In 2015, the Nilson Report, a publication that tracks the credit card industry, found that Visa's global network (known as VisaNet) processed 100 billion transactions during 2014 with a total volume of US$6.8 trillion.

[9] Nearly all Visa transactions worldwide are processed through the company's directly operated VisaNet at one of four secure data centers, located in Ashburn, Virginia and Highlands Ranch, Colorado in the United States; London, England; and in Singapore.

[10] These facilities are heavily secured against natural disasters, crime, and terrorism; can operate independently of each other and from external utilities if necessary; and can handle up to 30,000 simultaneous transactions and up to 100 billion computations every second.

[1] In the weeks leading up to the launch of BankAmericard, BofA had saturated Fresno mailboxes with an initial mass mailing (or "drop", as they came to be called) of 65,000 unsolicited credit cards.

[1][14] BankAmericard was the brainchild of BofA's in-house product development think tank, the Customer Services Research Group, and its leader, Joseph P. Williams.

[15] Williams' pioneering accomplishment was that he brought about the successful implementation of the all-purpose credit card (in the sense that his project was not canceled outright), not in coming up with the idea.

[15] By the mid-1950s, the typical middle-class American already maintained revolving credit accounts with several different merchants, which was clearly inconvenient and inefficient due to the need to carry so many cards and pay so many separate bills each month.

Twenty-two percent of accounts were delinquent, not the 4% expected, and police departments around the state were confronted by numerous incidents of the brand new crime of credit card fraud.

[20] Both politicians and journalists joined the general uproar against Bank of America and its newfangled credit card, especially when it was pointed out that the cardholder agreement held customers liable for all charges, even those resulting from fraud.

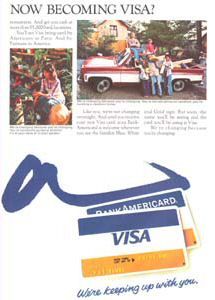

For this reason, in 1976, BankAmericard, Barclaycard, Carte Bleue, Chargex, Sumitomo Card, and all other licensees united under the new name, "Visa",[33] which retained the distinctive blue, white and gold flag.

Later, it was decided to use "average daily balance" which resulted in increased revenue for the issuers by calculating the number of days each purchase was included on the prior month's statement.

[45] On March 20, 2008, the IPO underwriters (including JP Morgan, Goldman Sachs & Co., Bank of America Securities LLC, Citi, HSBC, Merrill Lynch & Co., UBS Investment Bank and Wachovia Securities) exercised their overallotment option, purchasing an additional 40.6 million shares, bringing Visa's total IPO share count to 446.6 million, and bringing the total proceeds to US$19.1 billion.

[57] On November 5, 2020, the United States Department of Justice filed a lawsuit seeking to block the acquisition, arguing that Visa is a monopolist trying to eliminate a competitive threat by purchasing Plaid.

[60] On February 3, 2021, Visa announced a partnership with First Boulevard, a neobank promoting cryptocurrency, which has been touted as a means of building generational wealth for Black Americans.

[86] In return DataCell, the IT company that enables WikiLeaks to accept credit and debit card donations, announced that it would take legal action against Visa Europe.

The suit says that this price-fixing artificially raises the price that consumers pay using ATMs, limits the revenue that ATM-operators earn, and violates the Sherman Act's prohibition against unreasonable restraints of trade.

Johnathan Rubin, an attorney for the plaintiffs said, "Visa and MasterCard are the ringleaders, organizers, and enforcers of a conspiracy among U.S. banks to fix the price of ATM access fees in order to keep the competition at bay.

[98] On November 27, 2012, a federal judge entered an order granting preliminary approval to a proposed settlement to a class-action lawsuit[99] filed in 2005 by merchants and trade associations against Mastercard and Visa.

In their complaint, the plaintiffs also alleged that the defendants unfairly interfere with merchants from encouraging customers to use less expensive forms of payment such as lower-cost cards, cash, and checks.

Mike Schlotman, Kroger's executive vice president/chief financial officer, said Visa had been "misusing its position and charging retailers excessive fees for a long time."

[106][107] In November 2020, the United States Department of Justice (DOJ) sued to block Visa's acquisition of fintech startup Plaid, claiming that the merger would violate antitrust laws.

[110] In March 2021, the United States Justice Department announced its investigation with Visa to discover if the company is engaging in anticompetitive practices in the debit card market.

[120][121] In December 2010, Visa reached a settlement with the European Union in yet another antitrust case, promising to reduce debit card payments to 0.2 percent of a purchase.

[128] In May 2024, the UK Payment Systems Regulator (PSR) proposed new rules requiring Visa and Mastercard to increase transparency regarding the fees they charge merchants.

In 2009, Visa moved its corporate headquarters back to San Francisco when it leased the top three floors of the 595 Market Street office building, although most of its employees remained at its Foster City campus.

[137] Visa also announced that it would redesign its current four-building complex in Foster City to 575,000 square feet, for offices for 3,000 employees in its product and technology teams.

[138] The building features outdoor terraces, a rooftop deck, and views of San Francisco Giants baseball games and other events at Oracle Park across McCovey Cove.

[142] In ten U.S. states, surcharges for the use of a credit card are forbidden by law (California, Colorado, Connecticut, Florida, Kansas, Maine, Massachusetts, New York, Oklahoma and Texas) but a discount for cash is permitted under specific rules.

The Visa Checkout service allows users to enter all their personal details and card information, then use a single username and password to make purchases from online retailers.

[163] Visa made a statement on January 12, 2018, that the signature requirement would become optional for all EMV contact or contactless chip-enabled merchants in North America starting in April 2018.