Brazilian packaging market

[3][4] For the period between 2011 and 2016, Brazil shows an estimated median growth of 6.2%, realizing a sales value of US$34 billion in 2016, leaving behind Canada and being on a level with France.

[5] The demand for environmentally friendly packaging types has also been increasing steadily since the 2000s and the resulting growth from innovation contributes to this trend.

The chemical and agricultural sectors predominantly use plastics and metals due to their products requiring packaging with high durability.

Low production costs are another important factor in explaining the popularity of plastics and flexibles in the Brazilian packaging sector.

[10] Despite delivering examples from the Brazilian market, these five tendencies are not taylor-made for Brazil, as they - to large parts - also apply to the packaging industry as a whole.

With regard to food, the popularity of packaging that enables a quick and simple preparation (e.g. in the microwave) also keeps rising.

[13] Colors transmit esthetics, yet post 2010 developments in the Brazilian packaging market show a rising preference of simple styles by customers.

The packaging sector provides opportunities for new technologies as well as new types of materials that improve a product's lifespan and microbiological safety.

Yet, new packaging types tend to face issues like a higher price and hence, difficulties in competition with the cheaper fossil-based materials.

Life cycle assessments and Life-cycle thinking in general are regarded as the best instruments to calculate the environmental costs of a product or service.

Sustainability is not only achieved by using 100% renewable materials, but also by, for instance, making packaging smaller so that more units of the product can be shipped at a time, which in turn reduces the collective carbon footprint.

Given an increased amount of recycled material, functioning waste management and reverse logistics are indispensable and promise to be an auspicious market for innovative products and services.

Additionally to that, the Brazilian National Health Surveillance Agency (ANVISA) must be informed about any imports of FCM whatsoever.

[17] Laws are constantly being revised in order to match newly acquired scientific and technological insights and steadily evolving products.

While showing immense growth (CAGR of 6,1% in volume and 5,8% in value between 2011 and 2014), the distribution of Stand Up Pouches in Brazil yet lags behind the Chilean and the U.S. market, which is due to a lack of supply of scale of important components like resealable zippers and nylon, causing the price for the production of Stand Up Pouches to be higher than in comparable markets.

Because of the trade-off of having a high initial investment but low operational costs, VFFS is more of a long-run rather than short-run option and useful for the production of large quantities.

[21] Typical products that come in Stand Up Pouch packaging are nuts, cereals, dog and cat food, liquid soap and smaller quantities of laundry detergents.

For the production of its bottle, Coca-Cola is supplied by the Brazilian petrochemical and biopolymers company Braskem, who produce polyethylene that is based in its entirety on sugarcane ethanol.

Sugarcane ethanol is produced in areas that are located in at least 2000 km distance from the Amazon rainforest, that is, in the Northeast coastal regions as well as in the Southeast, with 60% of the production taking place in the State of São Paulo.

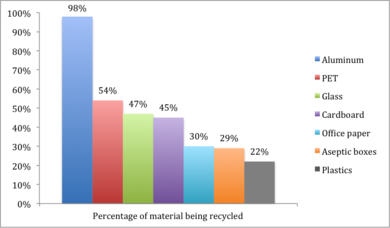

[30] Compared to developed OECD states, Brazil has a fairly low total recycling rate, being at 2% of created waste.

Sejaa, which was launched by Brazilian fashion model Gisele Bündchen uses fibers consisting to 100% of recycled post-consumer waste paper and is Forest Stewardship certified.

[39][40] Another example is Brazilian pulp and paper manufacturer Suzano, which since 2012 produces paperboard made from Post consumer resin (PCR) by extracting fibers from long life packaging[41] such as milk cartons.