Market trend

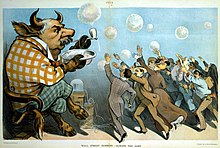

The latter term might have originated by analogy to bear-baiting and bull-baiting, two animal fighting sports of the time.

He remarked that bulls who bought in excess of present demand might be seen wandering among brokers' offices moaning for a buyer, while bears rushed about devouring any shares they could find to close their short positions.

An unrelated folk etymology supposes that the terms refer to a bear clawing downward to attack and a bull bucking upward with its horns.

An example of a secular bear market occurred in gold from January 1980 to June 1999, culminating with the Brown Bottom.

A primary trend has broad support throughout the entire market, across most sectors, and lasts for a year or more.

One generally accepted measure of a bear market is a price decline of 20% or more over at least a two-month period.

Identifying a market bottom, often referred to as 'bottom picking,' is a challenging task, as it's difficult to recognize before it passes.

The upturn following a decline may be short-lived, and prices might resume their descent, resulting in a loss for the investor who purchased stocks during a misperceived or 'false' market bottom.

Baron Rothschild is often quoted as advising that the best time to buy is when there is 'blood in the streets'—that is, when the markets have fallen drastically and investor sentiment is extremely negative.

[21] Some more examples of market bottoms, in terms of the closing values of the Dow Jones Industrial Average (DJIA) include: Secondary trends are short-term changes in price direction within a primary trend, typically lasting for a few weeks or a few months.

Supply and demand dynamics vary as investors attempt to reallocate their investments between asset types.

While this principle holds true for many assets, it often operates in reverse for stocks due to the common mistake made by investors—buying high in a state of euphoria and selling low in a state of fear or panic, driven by the herding instinct.

When an extremely high proportion of investors express a bearish (negative) sentiment, some analysts consider it to be a strong signal that a market bottom may be near.

[29] David Hirshleifer observes a trend phenomenon that follows a path starting with under-reaction and culminating in overreaction by investors and traders.

Indicators that measure investor sentiment may include:[citation needed] Media related to Market trends at Wikimedia Commons