Renminbi

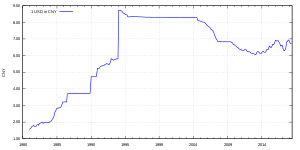

[5] However, more recently, appreciation actions by the Chinese government, as well as quantitative easing measures taken by the American Federal Reserve and other major central banks, have caused the renminbi to be within as little as 8% of its equilibrium value by the second half of 2012.

[16] From 1949 until the late 1970s, the state fixed China's exchange rate at a highly overvalued level as part of the country's import-substitution strategy.

During this time frame, the focus of the state's central planning was to accelerate industrial development and reduce China's dependence on imported manufactured goods.

The overvaluation allowed the government to provide imported machinery and equipment to priority industries at a lower domestic currency cost than otherwise would have been possible.

[citation needed] The most important move to a market-oriented exchange rate was an easing of controls on trade and other current account transactions, as occurred in several very early steps.

[citation needed] The government also gradually allowed market forces to take the dominant role by introducing an "internal settlement rate" of ¥2.8 to 1 US dollar which was a devaluation of almost 100%.

"[25] The PBOC has filed more than 80 patents surrounding the integration of a digital currency system, choosing to embrace the blockchain technology.

Several of the 84 patents reviewed by the Financial Times indicate that China may plan to algorithmically adjust the supply of a central bank digital currency based on certain triggers, such as loan interest rates.

[26] Uncovered by the Chamber of Digital Commerce (an American non-profit advocacy group), their contents shed light on Beijing's mounting efforts to digitise the renminbi, which has sparked alarm in the West and spurred central bankers around the world to begin exploring similar projects.

[28] Eswar Prasad, an economics professor at Cornell University, said that the digital renminbi "will hardly put a dent in the dollar's status as the dominant global reserve currency" due to the United States' "economic dominance, deep and liquid capital markets, and still-robust institutional framework".

The Guardian quoted a China Daily report which stated "A sovereign digital currency provides a functional alternative to the dollar settlement system and blunts the impact of any sanctions or threats of exclusion both at a country and company level.

The denomination and the words "People's Bank of China" are also printed in Mongolian, Tibetan, Uyghur and Zhuang on the back of each banknote, in addition to the boldface Hanyu Pinyin "Zhongguo Renmin Yinhang" (without tones).

These depict the national emblem on the obverse (front) and the name and denomination framed by wheat stalks on the reverse (back).

In recognition of the imminent 2022 Winter Olympics, the People's Bank of China issued ¥20 commemorative banknotes in both paper and polymer in December 2021.

[44] CBPMC uses several printing, engraving and minting facilities around the country to produce banknotes and coins for subsequent distribution.

On 13 March 2006, some delegates to an advisory body at the National People's Congress proposed to include Sun Yat-sen and Deng Xiaoping on the renminbi banknotes.

[49] Chinese leadership have been raising the yuan to tame inflation, a step U.S. officials have pushed for years to lower the massive trade deficit with China.

However, the peg was reinstituted unofficially when the financial crisis hit: "Under intense pressure from Washington, China took small steps to allow its currency to strengthen for three years starting in July 2005.

[54] The news was greeted with praise by world leaders including Barack Obama, Nicolas Sarkozy and Stephen Harper.

The renminbi rose to its highest level in five years and markets worldwide surged on Monday, 21 June following China's announcement.

In his article, he narrated that "Weak trade data out of China, released over the weekend, weighed on the currencies of Australia and New Zealand on Monday.

Indeed, the Chinese currency, also known as the renminbi, has been remarkably steady over the past month despite the huge selloff in China's stock market and a spate of disappointing economic data.

"[57] The renminbi has now moved to a managed floating exchange rate based on market supply and demand with reference to a basket of foreign currencies.

Once the sum was paid by the foreign party in dollars, the central bank would pass the settlement in renminbi to the Chinese company at the state-controlled exchange rate.

[82] The "Report on the Internationalization of RMB in 2020", which was released by the People's Bank of China in August 2020, said that renminbi's function as international reserve currency has gradually emerged.

[83] The two special administrative regions, Hong Kong and Macau, have their own respective currencies, according to the "one country, two systems" principle and the basic laws of the two territories.

[86] Because of changes in legislation in July 2010, banks around the world[87] offer foreign currency accounts for deposits in Chinese renminbi.

[88] The Republic of China, which governs Taiwan, believes wide usage of the renminbi would create an underground economy and undermine its sovereignty.

[95] Cambodia welcomes the renminbi as an official currency and Laos and Myanmar allow it in border provinces such as Wa and Kokang and economic zones like Mandalay.

Beijing has allowed renminbi-denominated financial markets to develop in Hong Kong as part of the effort to internationalise the renminbi.