Central bank

Central banks play a crucial role in macroeconomic forecasting, which is essential for guiding monetary policy decisions, especially during times of economic turbulence.

The difference is that government-issued financial money, as present e.g. in China during the Yuan dynasty in the form of paper currency, is typically not freely convertible and thus of inferior quality, occasionally leading to hyperinflation.

In the early 18th century, a major experiment in national central banking failed in France with John Law's Banque Royale in 1720–1721.

Later in the century, France had other attempts with the Caisse d'Escompte first created in 1767, and King Charles III established the Bank of Spain in 1782.

[34][35] Napoleon created the Banque de France in 1800, in order to stabilize and develop the French economy and to improve the financing of his wars.

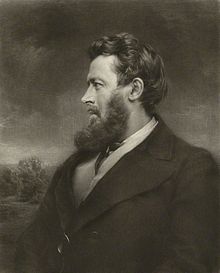

Henry Thornton, an opponent of the real bills doctrine, was a defender of the bullionist position and a significant figure in monetary theory.

[44] The Bank of England took over a role of lender of last resort in the 1870s after criticism of its lacklustre response to the failure of Overend, Gurney and Company.

[46] Following World War I, the Economic and Financial Organization (EFO) of the League of Nations, influenced by the ideas of Montagu Norman and other leading policymakers and economists of the time, took an active role to promote the independence of central banks, a key component of the economic orthodoxy the EFO fostered at the Brussels Conference (1920).

By the early 21st century, most of the world's countries had a national central bank set up as a public sector institution, albeit with widely varying degrees of independence.

The State Bank of Morocco was established in 1907 with international shareholding and headquarters functions distributed between Paris and Tangier, a half-decade before the country lost its independence.

Yet another pattern was set in countries where federated or otherwise sub-sovereign entities had wide policy autonomy that was echoed to varying degrees in the organization of the central bank itself.

Conversely, some countries that are politically organized as federations, such as today's Canada, Mexico, or Switzerland, rely on a unitary central bank.

As a regulator of one of the most widespread currencies in the global economy, the US Federal Reserve plays an outsized role in the international monetary market.

Being the main supplier and rate adjusted for US dollars, the Federal Reserve implements a set of requirements to control inflation and unemployment in the US.

Keynes labeled any jobs that would be created by a rise in wage-goods (i.e., a decrease in real-wages) as involuntary unemployment: Economic growth can be enhanced by investment in capital, such as more or better machinery.

On the other hand, raising the interest rate is often used in times of high economic growth as a contra-cyclical device to keep the economy from overheating and avoid market bubbles.

In the aftermath of the Paris agreement on climate change, a debate is now underway on whether central banks should also pursue environmental goals as part of their activities.

Proponents of "green monetary policy" are proposing that central banks include climate-related criteria in their collateral eligibility frameworks, when conducting asset purchases and also in their refinancing operations.

[57][58][59] In response, four broad types of interventions including methodology development, investor encouragement, financial regulation and policy toolkits have been adopted by or suggested for central banks.

A significant challenge lies in the lack of awareness among corporations and investors, driven by poor information flow and insufficient disclosure.

[20] Although there is a historical bias toward high-carbon companies, included in Central banks portfolios due to their high credit ratings, innovative approaches to quantitative easing could invert this trend to favor low-carbon assets.

[20] For example, the European Central Bank has incorporated carbon-emissions into its asset purchase criteria, despite its relatively narrow mandate that focuses on price stability.

The primary monetary policy tool available to central banks is the administered interest rate paid on qualifying deposits held with them.

Central banks have increasingly engaged in public communication to ensure accountability, build trust, and manage inflation expectations.

[73] Various aspects of central bank communication are also analyzed, including textual content through text mining techniques,[74] facial expressions during press conferences,[75] vocal characteristics,[76] and the clarity and readability of monetary policy announcements.

When governments control monetary policy, politicians may be tempted to boost economic activity in advance of an election to the detriment of the long-term health of the economy and the country.

As a consequence, financial markets may not consider future commitments to low inflation to be credible when monetary policy is in the hands of elected officials, which increases the risk of capital flight.

For example, the Board of Governors of the U.S. Federal Reserve are nominated by the U.S. president and confirmed by the Senate,[85] publishes verbatim transcripts, and balance sheets are audited by the Government Accountability Office.

The IMF's Financial Services Action Plan (FSAP) review self-assessment, for example, includes a number of questions about central bank independence in the transparency section.

According to data compiled by Bloomberg News, the top 10 largest central banks owned $21.4 trillion in assets, a 10 percent increase from 2015.