European Central Bank

[7] The EMI was established at the start of the second stage of the EU's Economic and Monetary Union (EMU) to handle the transitional issues of states adopting the euro and prepare for the creation of the ECB and European System of Central Banks (ESCB).

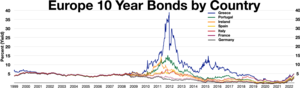

The so-called European debt crisis began after Greece's new elected government uncovered the real level indebtedness and budget deficit and warned EU institutions of the imminent danger of a Greek sovereign default.

TFEU),[18] An over-interpretation of this limitation, inhibited the ECB from implementing quantitative easing like the Federal Reserve and the Bank of England did as soon as 2008, which played an important role in stabilizing markets.

Although it had deferred the cash cost of recapitalising the failing Anglo Irish Bank by nationalising it and issuing it with a "promissory note" (an IOU), the Government also faced a large deficit on its non-banking activities, and it therefore turned to the official sector for a loan to bridge the shortfall until its finances were credibly back on a sustainable footing.

[1] In a report adopted on 13 March 2014, the European Parliament criticized the "potential conflict of interest between the current role of the ECB in the Troika as 'technical advisor' and its position as a creditor of the four Member States, as well as its mandate under the Treaty".

Facing renewed fears about sovereigns in the eurozone continued Mario Draghi made a decisive speech in London, by declaring that the ECB "...is ready to do whatever it takes to preserve the Euro.

[49] Even if OMT was never actually implemented until today, it made the "Whatever it takes" pledge credible and significantly contributed to stabilizing financial markets and ending the sovereign debt crisis.

[65] Further, these operations were devoid of monitoring from the ECB regarding the use made of these liquidities[65] and it appeared that banks had significantly used these funds to pursue carry-trade strategies,[66] purchasing sovereign bonds with higher rates and corresponding maturity to generate profits, instead of increasing private lending.

On 12 March 2020, the ECB announced a set of policy measures such as an additional package of net asset purchases of €120 billion by the end of 2020 under the already existing APP, and more favorable terms on the TLTRO III.

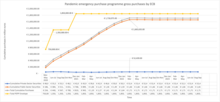

[82] On 19 March 2020—less than one week after Lagarde's unfortunate statements on the spreads—the ECB announced by surprise the launch of the Pandemic Emergency Purchase Programme (PEPP) worth €750 billion to boost liquidity in the European economy and to contain any sharp increases in sovereign yield spreads.

[88][79][89] The purpose of the PEPP was to stabilize sovereign bonds yields to low and stable levels, thus preventing self-fulfilling panicks in financial markets as was the case during the European debt crisis.

[110] Of the total €1.850 billion available under the PEPP, 93% of the full envelope wase used, due to indications of decreased financial stress in the Euro Area, mainly thanks to relaxation of COVID restrictions and the reopening of European markets.

The Transmission Protection Instrument (TPI) is a tool the ECB could use to ensure monetary policy decisions are smoothly transmitted across all euro area countries, introduced on July 21, 2022.

In the summer of 2021, coinciding with the European Central Bank's announcement of its revised monetary policy framework and its initiative for climate action, the eurozone witnessed a notable inflationary surge.

[149] This shift aimed to institutionalize the ECB's evolving role, moving beyond the singular focus on price stability—a policy shaped largely by the aftermath of the European sovereign debt crisis.

[139] Nevertheless, ECB policymakers effectively drew connections between the Central Bank Independence (CBI) framework and the experiences of the stagflation era to rationalize their decision to increase interest rates, avoiding the need for a discourse on regime change.

Paul Krugman argued that the current inflationary surge would prove to be transitory, whereas other economists such as Olivier Blanchard and Larry Summers had issued warnings regarding the possible persistence of this inflation.

Phasing out the Asset Purchase Programs thus signals alignment with the different policy rate hikes in an attempt to cool down the economy and demonstrates a commitment to combating inflation.

[157][158][159] Research indicates that the European Central Bank responded to the escalating inflation more slowly and cautiously than the FED, showing hopes that a moderate tightening of monetary policy would suffice.

[163] Traditional indicators used for forecasting economic dynamics, such as the output and unemployment gaps, were found to be inadequate in signaling the overheating of the economy and the prevailing tight labor market conditions.

During this period, inflation expectations remained relatively stable, leading to the misinterpretations by the European Central Bank and other monetary authorities regarding the inflationary trend's nature.

These studies support the ECB's decision to follow the Federal Reserve's lead in raising policy rates, which appears to have been a strategic move to curb imported inflation and address the spike in energy prices.

[170] In May 2003, following a thorough review of the ECB's monetary policy strategy, the Governing Council clarified that "in the pursuit of price stability, it aims to maintain inflation rates below, but close to, 2% over the medium term".

"[172] On 8 July 2021, as a result of the strategic review led by the new president Christine Lagarde, the ECB officially abandoned the "below but close to two per cent" definition and adopted instead a 2% symmetric target.

[182][183] To carry out its main mission, the ECB's tasks include: The principal monetary policy tool of the European central bank is collateralised borrowing or repo agreements.

[194] The Spanish had nominated Barcelona-born Antonio Sáinz de Vicuña – an ECB veteran who heads its legal department – as González-Páramo's replacement as early as January 2012, but alternatives from Luxembourg, Finland, and Slovenia were put forward and no decision made by May.

[195] After a long political battle and delays due to the European Parliament's protest over the lack of gender balance at the ECB,[196] Luxembourg's Yves Mersch was appointed as González-Páramo's replacement.

[214][215][216][217] In general terms, this means that the Eurosystem tasks and policies can be discussed, designed, decided and implemented in full autonomy, without pressure or need for instructions from any external body.

On the theoretical side, it's believed that time inconsistency suggests the existence of political business cycles where elected officials might take advantage of policy surprises to secure reelection.

Holding the John Paulson Chair in European Political Economy at the London School of Economics, de Grauwe presented his views on this matter in a lecture at the Bundesbank in September 2023.