Criticism of the Federal Reserve

Notable critics include Nobel laureate economist Milton Friedman and his fellow monetarist Anna Schwartz, who argued that the Fed's policies exacerbated the Great Depression.

[1] Critics have also raised concerns about the Fed's role in fractional reserve banking, its contribution to economic cycles, and its transparency.

The Fed has been accused of causing economic downturns, including the 2007-2008 financial crisis,[2] and of being influenced by private interests.

Despite these criticisms, the Federal Reserve remains a central institution in the United States' financial system, with ongoing debates about its role, policies, and the need for reform.

An early version of the Federal Reserve Act was drafted in 1910 on Jekyll Island, Georgia, by Republican Senator Nelson Aldrich, chairman of the National Monetary Commission, and several Wall Street bankers.

The final version, with provisions intended to improve public oversight and weaken the influence of the New York banking establishment, was drafted by Democratic Congressman Carter Glass of Virginia.

He called the Fed policy of money creation "legalized counterfeiting" and favored a return to the gold standard.

[7] This has led to a number of proposed changes including advocacy of different policy rules[8] or dramatic restructuring of the system itself.

[9] Milton Friedman concluded that governments do have a role in the monetary system,[10] he was critical of the Federal Reserve due to its poor performance and felt it should be abolished.

Senator Robert Owen, whose name was on the Glass-Owen Federal Reserve Act, believed that the Fed was not performing as promised.

Representative Louis T. McFadden, Chairman of the House Committee on Banking and Currency from 1920 to 1931, accused the Federal Reserve of deliberately causing the Great Depression.

Representative Ron Paul, Chairman of the Monetary Policy Subcommittee in 2011, is known as a staunch opponent of the Federal Reserve System.

[26] He routinely introduced bills to abolish the Federal Reserve System,[27] three of which gained approval in the House but lost in the Senate.

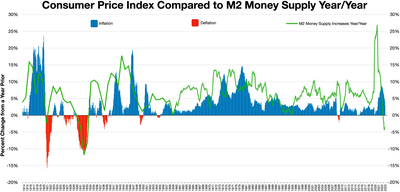

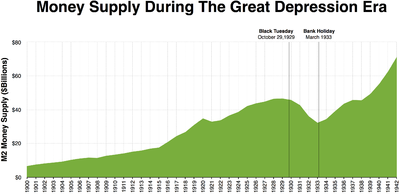

[31] Milton Friedman and Anna Schwartz stated that the Fed pursued an erroneously restrictive monetary policy, exacerbating the Great Depression.

"[32] Before the establishment of the Federal Reserve, the banking system had dealt with periodic crises (such as in the Panic of 1907) by suspending the convertibility of deposits into currency.

"[34] The result was what Friedman calls "The Great Contraction"—a period of falling income, prices, and employment caused by the choking effects of a restricted money supply.

The mechanism suggested by Friedman and Schwartz was that people wanted to hold more money than the Federal Reserve was supplying.

Friedman and Schwartz argued the Federal Reserve allowed the money supply to plummet because of ineptitude and poor leadership.

"[38] He preferred a system that would increase the money supply at some fixed rate, and he thought that "leaving monetary and banking arrangements to the market would have produced a more satisfactory outcome than was actually achieved through government involvement".

Some economists, such as John B. Taylor,[40] have asserted that the Fed was responsible, at least partially, for the United States housing bubble which occurred prior to the 2007 recession.

Senator Chris Dodd, then-chairman of the United States Senate Committee on Banking, Housing, and Urban Affairs, remarked about the Fed's role in the 2007-2008 economic crisis, "We saw over the last number of years when they took on consumer protection responsibilities and the regulation of bank holding companies, it was an abysmal failure."

the Tea Party movement has made the Federal Reserve a major point of attack, which has been picked up by Republican candidates across the country.

[47] In the book, Paul argues that "the government and its banking cartel have together stolen $0.95 of every dollar as they have pursued a relentlessly inflationary policy."

Rothbard attempted to intertwine both political and economic arguments together in order to make a case to abolish the Federal Reserve.

When first laying out his critiques, he writes "The Federal Reserve System is accountable to no one; it has no budget; it is subject to no audit; and no Congressional committee knows of...its operations.

"[53] This argument from Rothbard is outdated, however, as the Federal Reserve presently does report its balance sheet weekly as well as get audited by outside third parties.

"According to the Congressional Research Service: Because the regional Federal Reserve Banks are privately owned, and most of their directors are chosen by their stockholders, it is common to hear assertions that control of the Fed is in the hands of an elite.

Concentration of ownership of Federal Reserve Bank stock, therefore, is irrelevant to the issue of control of the system (italics in original).

"[58] These regional banks are in turn controlled by the Federal Reserve Board of Governors, whose seven members are nominated by the president of the United States and confirmed by the Senate.

[62] As of February 24, 2016, member banks with more than $10 billion in assets receive an annual dividend on their paid-in capital stock (Reserve Bank stock) of the lesser of 6% percent and the highest yield of the 10-year Treasury note auctioned at the last auction held prior to the payment of the dividend.