College tuition in the United States

An important predecessor was the Morrill Act of 1862, which provided for land-grant colleges using surplus federal lands recently acquired.

With the launch of the Sputnik satellite by the Soviet Union, many feared that the United States was falling behind on science and technology because it relied on private wealth to fund higher education, in contrast to the Soviet system, which was publicly funded and perceived by some to be more meritocratic and more closely tied to the needs of the economy and the military.

[2] During the late 1960s, as the nation's economic growth slowed, the question of who should pay for higher education came under fresh political scrutiny.

In California, Governor Ronald Reagan promoted cuts to higher education as a way to win favor with business interests and conservative voters.

In the context of a stagnant economy and a growing conservative movement embracing austerity, no-tuition policies fell out of favor in many areas of the country during this period.

[7] Due to the high price of college tuition, about 43 percent of students reject their first choice of schools.

[7] Between 2007–08 and 2017–18, published in-state tuition and fees at public four-year institutions increased at an average rate of 3.2% per year beyond inflation, compared with 4.0% between 1987–88 and 1997–98 and 4.4% between 1997–98 and 2007-08.

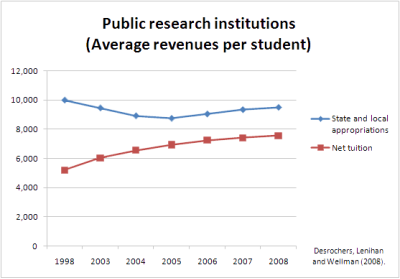

State support for public colleges and universities has fallen by about 26 percent per full-time student since the early 1990s.

[10][13] Critics say the shift from state support to tuition represents an effective privatization of public higher education.

[15] On the contrary, they appear to be both increasing and much higher than the returns on other investments such as the stock market, bonds, real estate, or private equity.

[21] One recent working paper posted online by the Federal Reserve Bank of New York in 2015 (revised in 2016) concluded that undergraduate institutions more exposed to increases in student loan program maximums tend to respond with modest raises in tuition prices.

A third, novel theory claims that the recent change in federal law removing all standard consumer protections (truth in lending, bankruptcy proceedings, statutes of limits, the right to refinance, adherence to usury laws, and Fair Debt & Collection practices, etc.)

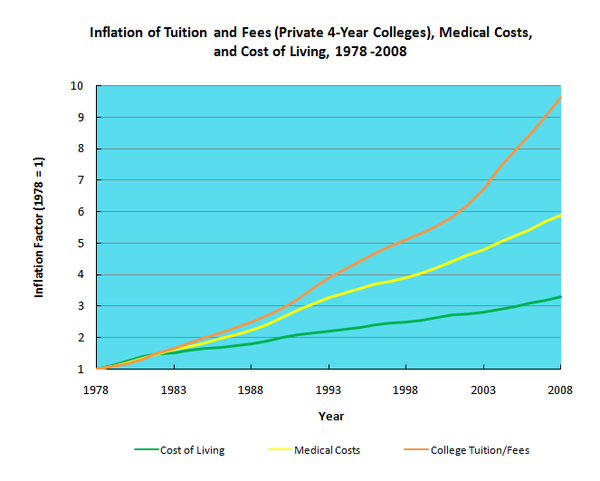

Thus, even after controlling for the effects of general inflation, 2008 college tuition and fees posed three times the burden as in 1978.

Several studies demonstrate that students from lower income families are more likely to drop out of college to avoid debt.

Middle class families are at risk because the increasing cost of college tuition may limit their acquisition of the education that allows them to succeed in their communities.

[39][40][41] Recent reports also indicate an increase in suicides directly attributable to the stress related to distressed and defaulted student loans.

[42][43][44][45] The adverse mental health impacts on the student population because of economic-induced stress are becoming a social concern.