Consumption smoothing

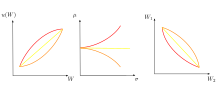

An optimal consumption rate should be relatively similar at each stage of a person's life rather than fluctuate wildly.

[1][2] Luxurious consumption at an old age does not compensate for an impoverished existence at other stages in one's life.

[2] Since income tends to be hump-shaped across an individual's life, economic theory suggests that individuals should on average have low or negative savings rate at early stages in their life, high in middle age, and negative during retirement.

Due to many possible states of the world, people want to decrease the amount of uncertain outcomes of the future.

[5] This explains why people purchase insurance, whether in healthcare, unemployment, and social security.

To help illustrate this, think of a simplified hypothetical scenario with Person A, who can exist in one of two states of the world.

In State X, Person A enjoys a good income from his work place and is able to spend money on necessities, such as paying rent and buying groceries, and luxuries, such as traveling to Europe.

In State Y, Person A no longer obtains an income, due to injury, and struggles to pay for necessities.

This leads to the support of microfinance as a tool to consumption smooth, stating that those in poverty value microloans tremendously due to its extremely high marginal utility.

Since Friedman's 1956 permanent income theory and Modigliani and Brumberg's 1954 life-cycle model, the idea that agents prefer a stable path of consumption has been widely accepted.

Friedman's theory argues that consumption is linked to the permanent income of agents.

Thus, when income is affected by transitory shocks, for example, agents' consumption should not change, since they can use savings or borrowing to adjust.

Empirical evidence shows that liquidity constraint is one of the main reasons why it is difficult to observe consumption smoothing in the data.

Hall's paper) agents choose the consumption path that maximizes: Subject to a sequence of budget constraints: The first order necessary condition in this case will be: By assuming that

we obtain, for the previous equation: Which, due to the concavity of the utility function, implies: Thus, rational agents would expect to achieve the same consumption in every period.

Robert Hall (1978) estimated the Euler equation in order to find evidence of a random walk in consumption.

Although Hall argues that he finds some evidence of consumption smoothing, he does so using a modified version.

Wilcox (1989) argue that liquidity constraint is the reason why consumption smoothing does not show up in the data.

[13] A recent meta-analysis of 3000 estimates reported in 144 studies finds strong evidence for consumption smoothing.