Corporate tax

[4][5][6] According to one study: "Regression analysis shows that a one-percentage-point increase in the marginal state corporate tax rate reduces wages 0.14 to 0.36 percent.

[8][9][10][11][12][13] According to the Adam Smith Institute, "Clausing (2012), Gravelle (2010) and Auerbach (2005), the three best reviews we found, basically conclude that most of the tax falls on capital, not labour."

A less recent example was the effort to restore heavy industries in the US[15] by enacting the 1981 Accelerated Cost Recovery System (ACRS), which offered favorable depreciation allowances that would in turn lower taxes and increase cash flow, thus encouraging investment during the recession.

For example, events related to the formation or reorganization of the corporation, which are treated as capital costs.

Mechanisms include combined or consolidated returns as well as group relief (direct benefit from items of another member).

Corporations, like other entities, may be subject to withholding tax obligations upon making certain varieties of payments to others.

[23] Hong Kong taxes resident and nonresident corporations only on income from sources within the country.

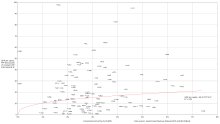

[28] Tax rates vary by jurisdiction and some countries have sub-country level jurisdictions like provinces, cantons, prefectures, cities, or other that also impose corporate income tax like Canada, Germany, Japan, Switzerland, and the United States.

[36] Corporate tax rates across the Organisation for Economic Co-operation and Development (OECD) are shown in the table.

For example, the United States provides for reduced amounts of tax on dividends received by individuals and by corporations.

In such jurisdictions, exceptions are usually provided with respect to distribution of shares of the company, for winding up, and in limited other situations.

[46] The United States provides reduced tax on dividend income of both corporations and individuals.

In addition, corporations may change key aspects of their legal identity, capitalization, or structure in a tax free manner under most systems.

[50] Most jurisdictions allow a tax deduction for interest expense incurred by a corporation in carrying out its trading activities.

For example, assume a corporation earns profits of 100 before interest expense and would normally distribute 50 to shareholders.

If the corporation is structured so that deductible interest of 50 is payable to the shareholders, it will cut its tax to half the amount due if it merely paid a dividend.

For example, interest paid on related party debt in excess of three times equity may not be deductible in computing taxable income.

[53] No international laws limit the ability of a country to tax its nationals and residents (individuals and entities).

[54] Upon payment of dividends, corporations are generally subject to withholding tax only by their country of incorporation.

Nathan M. Jenson argues that low corporate tax rates are a minor determinate of a multinational company when setting up their headquarters in a country.

In the United States and Netherlands, among others, this is accomplished by filing a single tax return including the income and loss of each group member.

In addition, a few systems provide a tax exemption for dividend income received by corporations.

A key issue in corporate tax is the setting of prices charged by related parties for goods, services or the use of property.

For tax years 2004–2010, the United States also has imposed a reduced rate of taxation on dividends received by individuals.

[citation needed] A previous system was utilised in the United Kingdom, called the advance corporation tax (ACT).

When a company paid a dividend, it was required to pay an amount of ACT, which it then used to offset its own taxes.

Modifications include longer depreciation lives assets under MACRS, adjustments related to costs of developing natural resources, and an addback of certain tax exempt interest.

These may be based on total equity per audited financial statements,[61] a computed amount of assets less liabilities[62] or quantity of shares outstanding.

[citation needed] Some systems require certification of tax returns in some manner by accountants licensed to practice in the jurisdiction, often the company's auditors.

[67] Returns for such systems generally require that the relevant financial statements be attached to a simple adjustment schedule.