Coupon (finance)

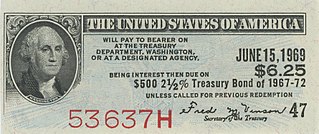

[3] The origin of the term "coupon" is that bonds were historically issued in the form of bearer certificates.

Physical possession of the certificate was (deemed) proof of ownership.

Several coupons, one for each scheduled interest payment, were printed on the certificate.

[8] During the European sovereign-debt crisis, some zero-coupon sovereign bonds traded above their face value as investors were willing to pay a premium for the perceived safe-haven status these investments hold.

[9] The difference between the price and the face value provides the bondholder with the positive return that makes purchasing the bond worthwhile.