Credit crunch

Many times, a credit crunch is accompanied by a flight to quality by lenders and investors, as they seek less risky investments (often at the expense of small to medium size enterprises).

For example, inadequate information about the financial condition of borrowers can lead to a boom in lending when financial institutions overestimate creditworthiness, while the sudden revelation of information suggesting that borrowers are or were less creditworthy can lead to a sudden contraction of credit.

The "hedge borrower" can make debt payments (covering interest and principal) from current cash flows from investments.

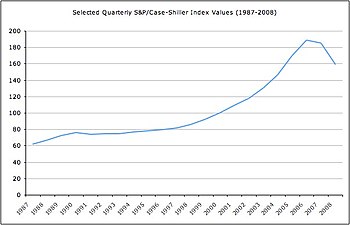

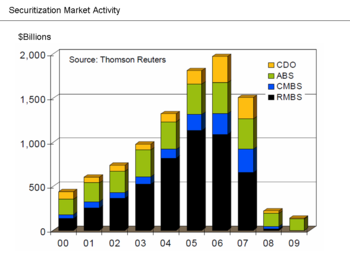

[12] This can result in widespread foreclosure or bankruptcy for those who came in late to the market, as the prices of previously inflated assets generally drop precipitously.

In this case, accessing additional credit lines and "trading through" the crisis can allow the business to navigate its way through the problem and ensure its continued solvency and viability.

Financial institutions may fail, economic growth may slow, unemployment may rise, and social unrest may increase.

For example, the ratio of household debt to after-tax income rose from 60% in 1984 to 130% by 2007, contributing to (and worsening) the Subprime mortgage crisis of 2007–2008.

Although few economists have successfully predicted credit crunch events before they have occurred, Professor Richard Rumelt has written the following in relation to their surprising frequency and regularity in advanced economies around the world: "In fact, during the past fifty years there have been 28 severe house-price boom-bust cycles and 28 credit crunches in 21 advanced Organisation for Economic Co-operation and Development (OECD) economies.