Currency war

States engaging in possible competitive devaluation since 2010 have used a mix of policy tools, including direct government intervention, the imposition of capital controls, and, indirectly, quantitative easing.

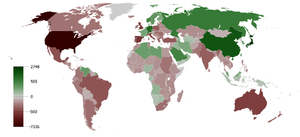

While many countries experienced undesirable upward pressure on their exchange rates and took part in the ongoing arguments, the most notable dimension of the 2010–11 episode was the rhetorical conflict between the United States and China over the valuation of the yuan.

From the early 1980s the International Monetary Fund (IMF) has proposed devaluation as a potential solution for developing nations that are consistently spending more on imports than they earn on exports.

[9] Quantitative easing (QE) is the practice in which a central bank tries to mitigate a potential or actual recession by increasing the money supply for its domestic economy.

This prompted widespread criticism from China, Germany, and Brazil that the United States was using QE2 to try to devalue its currency without consideration to the effect the resulting capital inflows might have on emerging economies.

[12][13][14] Some leading figures from the critical countries, such as Zhou Xiaochuan, governor of the People's Bank of China, have said the QE2 is understandable given the challenges facing the United States.

However, if much of the world is suffering from a recession, from low growth or are pursuing strategies which depend on a favourable balance of payments, then nations can begin competing with each other to devalue against a commonly and internationally accepted consideration.

[19] Rather than being seen as a means to help exporters, the debasement of currency was motivated by a desire to increase the domestic money supply and the ruling authorities' wealth through seigniorage, especially when they needed to finance wars or pay debts.

When nations wished to compete economically they typically practiced mercantilism – this still involved attempts to boost exports while limiting imports, but rarely by means of devaluation.

No currency war resulted because on the whole advanced economies accepted this strategy—in the short term it had some benefits for their citizens, who could buy cheap imports and thus enjoy a higher material standard of living.

In March 2009, even before international co-operation reached its peak with the 2009 G-20 London Summit, economist Ted Truman became one of the first to warn of the dangers of competitive devaluation.

Journalists linked Mantega's announcement to recent interventions by various countries seeking to devalue their exchange rate including China, Japan, Colombia, Israel and Switzerland.

[48] Martin Wolf, an economics leader writer with the Financial Times, suggested there may be advantages in western economies taking a more confrontational approach against China, which in recent years had been by far the biggest practitioner of competitive devaluation.

Although he advised that rather than using protectionist measures which may spark a trade war, a better tactic would be to use targeted capital controls against China to prevent them buying foreign assets in order to further devalue the yuan, as previously suggested by Daniel Gros, Director of the Centre for European Policy Studies.

[49][50] A contrasting view was published on 19 October, with a paper from Chinese economist Huang Yiping arguing that the US did not win the last "currency war" with Japan,[k] and has even less of a chance against China; but should focus instead on broader "structural adjustments" at the November 2010 G-20 Seoul summit.

[64][65] In March 2012, Rousseff said Brazil was still experiencing undesirable upwards pressure on its currency, with its Finance Minister Guido Mantega saying his country will no longer "play the fool" and allow others to get away with competitive devaluation, announcing new measures aimed at limiting further appreciation for the Real.

[67] In mid January 2013, Japan's central bank signalled the intention to launch an open ended bond buying programme which would likely devalue the yen.

[69] In early February, ECB president Mario Draghi agreed that expansionary monetary policy like QE have not been undertaken to deliberately cause devaluation.

However some analysts have stated that Japan's planned actions could be in the long term interests of the rest of the world; just as he did for the 2010–11 incident, economist Barry Eichengreen has suggested that even if many other countries start intervening against their currencies it could boost growth worldwide, as the effects would be similar to semi-coordinated global monetary expansion.

"[72] [73] [74] [75] On 15 February, a statement issued from the G20 meeting of finance ministers and central bank governors in Moscow affirmed that Japan would not face high level international criticism for its planned monetary policy.

In a remark endorsed by US Fed chairman Ben Bernanke, the IMF's managing director Christine Lagarde said that recent concerns about a possible currency war had been "overblown".

[76] Paul Krugman has echoed Eichengreen's view that central bank's unconventional monetary policy is best understood as a shared concern to boost growth, not as currency war.

In late October U.S. treasury officials had criticized Germany for running an excessively large current account surplus, thus acting as a drag on the global economy.

There has been no collaborative intent, but some economists such as Berkeley's Barry Eichengreen and Goldman Sachs's Dominic Wilson have suggested the net effect will be similar to semi-coordinated monetary expansion, which will help the global economy.

[39][88][l] James Zhan of the United Nations Conference on Trade and Development (UNCTAD), however, warned in October 2010 that the fluctuations in exchange rates were already causing corporations to scale back their international investments.

"[91] In February 2013, Gavyn Davies for The Financial Times emphasized that a key difference between the 1930s and the 21st-century outbreaks is that the former had some retaliations between countries being carried out not by devaluations but by increases in import tariffs, which tend to be much more disruptive to international trade.

[94] Jim Rickards, in his 2011 book "Currency Wars: The Making of the Next Global Crisis," argues that the consequences of the Fed's attempts to prop up economic growth could be devastating for American national security.

CWIII, he writes, is characterized by the Federal Reserve's policy of quantitative easing, which he ascribes to what he calls "extensive theoretical work" on depreciation, negative interest rates and stimulation achieved at the expense of other countries.

He offers a view of how the continued depreciation and devaluation of the dollar will ultimately lead to a collapse, which he asserts will come about through a widespread abandonment of a worthless inflated instrument.

"[97] Historically, the term has been used to refer to the competition between Japan and China for their currencies to be used as the preferred tender in parts of Asia in the years leading up to Second Sino-Japanese War.