Reserve currency

International currencies in the past have (excluding those discussed below) included the Greek drachma, coined in the fifth century BC, the Roman denarii, the Byzantine solidus and Islamic dinar of the middle-ages and the French franc.

The Venetian ducat and the Florentine florin became the gold-based currency of choice between Europe and the Arab world from the 13th to 16th centuries, since gold was easier than silver to mint in standard sizes and transport over long distances.

The Dutch, through the Amsterdam Wisselbank (the Bank of Amsterdam), were also the first to establish a reserve currency whose monetary unit was stabilized using practices familiar to modern central banking (as opposed to the Spanish dollar stabilized through American mine output and Spanish fiat) and which can be considered as the precursor to modern-day monetary policy.

The British pound sterling, in particular, was poised to dislodge the Spanish dollar's hegemony as the rest of the world transitioned to the gold standard in the last quarter of the 19th century.

At that point, the UK was the primary exporter of manufactured goods and services, and over 60% of world trade was invoiced in pounds sterling.

[6] On continental Europe, the bimetallic standard of the French franc remained the unifying currency of several European countries and their colonies under the Latin Monetary Union, which was established in 1865.

Additionally, in 1971 President Richard Nixon suspended the convertibility of the USD to gold, thus creating a fully fiat global reserve currency system.

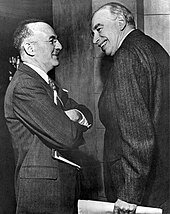

[12] Following the 2020 economic recession, the IMF opined about the emergence of "A New Bretton Woods Moment" which could imply the need for a new global reserve currency system.

The argument is that, in the absence of sufficiently large shocks, a currency that dominates the marketplace will not lose much ground to challengers.

However, some economists, such as Barry Eichengreen, argue that this is not as true when it comes to the denomination of official reserves because the network externalities are not strong.

As long as the currency's market is sufficiently liquid, the benefits of reserve diversification are strong, as it insures against large capital losses.

In the past due to the Plaza Accord, its predecessor bodies could directly manipulate rates to reverse large trade deficits.

[25][better source needed][needs update] The dollar's role as the undisputed reserve currency of the world allows the United States to impose unilateral sanctions against actions performed between other countries, for example the American fine against BNP Paribas for violations of U.S. sanctions that were not laws of France or the other countries involved in the transactions.

[26] In 2014, China and Russia signed a 150 billion yuan central bank liquidity swap line agreement to get around European and American sanctions on their behaviors.

Instead the euro's stability and future existence was put into doubt, and its share of global reserves was cut to 19% by year-end 2015 (vs 66% for the USD).

[36] Japan's yen is part of the International Monetary Fund's (IMF) special drawing rights (SDR) valuation.

The Canadian dollar (as a regional reserve currency for banking) has been an important part of the British, French and Dutch Caribbean states' economies and finance systems since the 1950s.

A report released by the United Nations Conference on Trade and Development in 2010, called for abandoning the U.S. dollar as the single major reserve currency.

[53] Due to the Russian invasion of Ukraine and international sanctions, Russia has used the United Arab Emirates dirham as a neutral currency when selling oil to India.

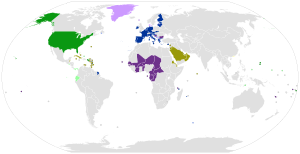

The value of SDRs are calculated from a basket determined by the IMF of key international currencies, which as of 2016 consisted of the United States dollar, euro, renminbi, yen, and pound sterling.

Ahead of a G20 summit in 2009, China distributed a paper that proposed using SDRs for clearing international payments and eventually as a reserve currency to replace the U.S.