Debit card

The need for cross-border compatibility and the advent of the euro recently led[dubious – discuss] to many of these card networks (such as Switzerland's "EC direkt", Austria's "Bankomatkasse", and Switch in the United Kingdom) being re-branded with the internationally recognized Maestro logo, which is part of the Mastercard brand.

The prepaid card programs benefit payments largely for the cost savings they offer and provide easier access to cash for recipients, as well as increased security.

The report also advises that governments should consider replacing any remaining cheque-based payments with prepaid card programs in order to realize substantial savings for taxpayers as well as benefits for payees.

Visa and MasterCard, for instance, prohibit minimum and maximum purchase sizes, surcharges, and arbitrary security procedures on the part of merchants.

The consumer perceives a debit transaction as occurring in real time: the money is withdrawn from their account immediately after the authorization request from the merchant.

Today, the majority of the financial transactions (like buying food at a supermarket), are made using debit cards (and this system is quickly replacing cash payments in Brazil).

Previously, debit cards have been in use for ABM usage since the late 1970s, with credit unions in Saskatchewan and Alberta introducing the first card-based, networked ATMs beginning in June 1977.

[5] In the early 1990s, pilot projects were conducted among Canada's six largest banks to gauge security, accuracy and feasibility of the Interac system.

[27] This popularity may be partially attributable to two main factors: the convenience of not having to carry cash, and the availability of automated bank machines (ABMs) and direct payment merchants on the network.

This imbalance dates from the unilateral introduction in France of Chip and PIN debit cards in the early 1990s, when the cost of this technology was much higher than it is now.

Germany has a dedicated debit card payment system called girocard which is usually co-branded with V Pay or Maestro depending on the issuing bank.

The point-of-sale terminal reads the bank sort code and account number from the card but instead of handling the transaction through the Girocard network it simply prints a form, which the customer signs to authorise the debit note.

The debit card transactions are routed through Rupay (mostly), Visa or MasterCard networks in India and overseas rather than directly via the issuing bank.

Other financial institutions that maintain a minority stake such as EBS, An Post Money and some credit unions use Mastercard Debit cards, as well as the exiting bank KBC.

For online purchases, the cards are used together with the bank's mobile app for Strong Customer Authentication as required by the EU's Payment Services Directive (PSD2).

Point of sale systems with integrated EFTPOS often send the purchase total to the terminal and the customer swipes their own card.

The EPS service has subsequently been extended in late 2005 to include the other Expressnet members: Banco de Oro and Land Bank of the Philippines.

It connects all point of sale (POS) terminals throughout the country to a central payment switch which in turn re-routes the financial transactions to the card issuer, local bank, Visa, Amex or MasterCard.

Since August 2018, all owners of transactional accounts in Serbian dinars are automatically issued a debit card of the national brand DinaCard.

In the UK debit cards (an integrated EFTPOS system) are an established part of the retail market and are widely accepted by both physical and internet stores.

However, the UK Government introduced legislation on 13 January 2018 banning all surcharges for card payments, including those made online and through services such as PayPal.

It is the West Africa Economic and Monetary Union federating eight countries: Benin, Burkina Faso, Ivory Coast, Guinea-Bissau, Mali, Niger, Senegal and Togo.

Debit cards in the United States are usually issued with a Visa, MasterCard, Discover[83] or American Express[84] logo allowing use of their signature-based networks.

As a result of the Dodd–Frank Wall Street Reform and Consumer Protection Act, U.S. merchants can now set a minimum purchase amount for credit card transactions, as long as it does not exceed $10.

A small but growing segment of the debit card business in the U.S. involves access to tax-favored spending accounts such as FSAs, HRAs, and HSAs.

Traditionally, FSAs (the oldest of these accounts) were accessed only through claims for reimbursement after incurring, and often paying, an out-of-pocket expense; this often happens after the funds have already been deducted from the employee's paycheck.

The only method permitted by the Internal Revenue Service (IRS) to avoid this "double-dipping" for medical FSAs and HRAs is through accurate and auditable reporting on the tax return.

In the United States, not all medical service or supply stores are capable of providing the correct information so an FSA debit card issuer can honor every transaction-if rejected or documentation is not deemed enough to satisfy regulations, cardholders may have to send in forms manually.

Since August 2014, with the Financial Inclusion Law coming into force, end consumers obtain a 4% VAT deduction for using debit cards in their purchases.

[93] There has been a lack of cash due to the Venezuelan economic crisis and thus the demand for and use of debit cards has increased greatly in recent years.

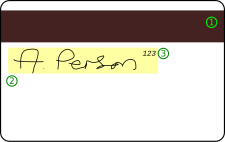

- Issuing bank logo

- EMV chip (optional and may depend on the issuing institution or bank)

- Hologram (this is located on the back on some cards, including most MasterCards)

- Card number (PAN) (may vary in length but mostly 16-digits with unique last 4 digits. However in cases such as Discover, Diner's Club, UnionPay & American Express it has a unique 15-digit card number)

- Card brand logo

- Expiration date

- Cardholder's name

- Magnetic stripe

- Signature strip panel

- Card Security Code