Economic history of the United Kingdom

British control of the oceans proved optimal in creating a liberal free-trade global economy, and helped Britain gain the lion's share of the world's carrying trade and financial support services.

[85]A free market for imported foodstuffs, the driving factor behind the 1846 repeal of the Corn Laws, reaped long-term benefits for consumers in Great Britain as world agricultural production increased.

Amalgamation of industrial cartels into larger corporations, mergers and alliances of separate firms, and technological advancement (particularly the increased use of electric power and internal combustion engines fuelled by petrol) were mixed blessings for British business during the late Victorian era.

[128] Evidence from Lever Brothers, Royal Dutch Shell, and Burroughs Wellcome indicates that after 1870 individual entrepreneurship by top leaders was critical in fostering the growth of direct foreign investment and the rise to prominence of multinational corporations.

However, problems in obtaining coal supplies and the failure to meet the firm's production goals forced Cargo Fleet to drop its aggressive system and return to the sort of approach South Durham Steel was using.

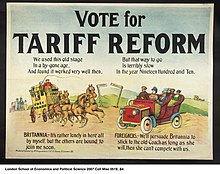

The recovery, moreover, was weaker than the mid-century growth in exports, because British manufactures were struggling to compete with domestically produced products in nations like Germany and the United States, where steep exclusionary tariffs had been enforced in response to the economic crisis.

The offspring of first and second-generation industrialists in the late 19th-century, raised in privilege and educated at aristocratically dominated public schools, showed little interest in adopting their father's occupations because of the stigma attached to working in manufacturing or "trade".

A major goal of the Tariff Reform League was the foundation of an Imperial Customs Union, which would create a closed trade bloc in the British Empire and, it was hoped, fully integrate the economies of Britain and her overseas possessions.

It forced Britain to use up its financial reserves and borrow large sums from the U.S.[169] Because of its prime importance in international finance, the entry of the UK into the war in August 1914 threatened a possible worldwide liquidity crisis.

The diversion of shipping and production towards the war effort between 1914 and 1918 meant that regional producers like the United States in Latin America or Japan in the Far East usurped important markets for British goods.

The despair reflected what Finlay (1994) describes as a widespread sense of hopelessness that prepared local business and political leaders to accept a new orthodoxy of centralised government economic planning when it arrived during the Second World War.

Academic experts, such as Professor Oliver Arnold led research into the development of phospho-magnetic steels and other specialised high-strength alloys, using the electric furnace and other innovations, as well as reducing smoke pollution.

[206] These industries were overwhelmingly concentrated in the communities surrounding London and cities in the West Midlands, particularly Coventry and Birmingham, where there was an established workforce skilled in the production of high quality metal goods.

Higher wages and shorter working hours also led to the rise of recreation: Gramophone records, radio (or "the wireless" as it was referred), magazines and cinema became part of everyday life much like sports, primarily football and cricket.

While the Wall Street crash of 1929 had little direct impact on the British stock market, the collapse of the American economy which it had foretold and the associated contraction of world trade seriously affected Britain in the early 1930s.

[224] Anticipating the end of the conflict, the United States had negotiated throughout the war to liberalise post-war trade and the international flow of capital in order to break into markets which had previously been closed to it, including the British Empire's Pound Sterling bloc.

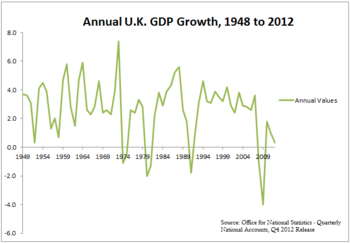

[239]As noted by historian Martin Pugh: Keynesian economic management enabled British workers to enjoy a golden age of full employment which, combined with a more relaxed attitude towards working mothers, led to the spread of the two-income family.

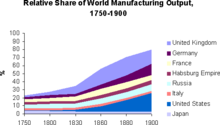

This explanation is known as the "early start theory" among economists, and explains why European nations showed markedly stronger levels of absolute growth in industry compared to the UK, a country which was already transitioning into a post-industrial, service-based economy.

Tony Judt described the prevailing attitude of post-war industrialists: "British factory managers preferred to operate in a cycle of under-investment, limited research and development, low wages and a shrinking pool of clients, rather than risk a fresh start with new products in new markets.

[249] However, by the late 1950s, the economies of West Germany, France, Japan, and Italy, had recovered from wartime infrastructure damage, replacing destroyed stock with state-of-the-art machinery and applying modern production methods in a process called "rejuvenation by defeat".

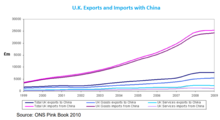

Britain had enjoyed a virtual monopoly of the consumer markets within the Empire, enforced by the closed Pound Sterling Bloc, but it could not compete once the territories gained independence and were free to negotiate their own trade agreements.

[252] Within days of the invasion, the UK had declared a cease-fire and Prime Minister Anthony Eden was appealing to the International Monetary Fund for a $560 million loan, which was only granted on the condition that the country vacate the Canal Zone.

Labour politician Richard Crossman, after visiting prosperous Canada, returned to England with a "sense of restriction, yes, even of decline, the old country always teetering on the edge of a crisis, trying to keep up appearances, with no confident vision of the future.

The third approach emphasised the drag of "Imperial distractions", whereby Britain's responsibilities to its extensive, though rapidly declining empire handicapped the domestic economy, especially through defence spending, and economic aid.

[279] Also in the 1970s, oil was found in the North Sea, off the coast of Scotland, although its contribution to the UK economy was minimised by the need to pay for rising national debt and for welfare payments to the growing number of unemployed people.

Economic growth was not re-established until early 1993, but the Conservative government which had been in power continuously since 1979 managed to achieve re-election in April 1992, fending off a strong challenge from Neil Kinnock and Labour, although with a significantly reduced majority.

Blair stepped down two years later after a decade as prime minister to be succeeded by the former Chancellor Gordon Brown, the change of leader coming at a time when Labour was starting to lag behind the Conservatives (led by David Cameron) in the opinion polls.

"[317] The downturn in the economy during 2008 and 2009 saw the popularity of the Labour government slump, and opinion polls all showed the Conservatives in the lead during this time, although by early 2010 the gap between the parties was narrow enough to suggest that the imminent general election would result in a hung parliament – as happened in May 2010.

The Northern Ireland Protocol is intended to protect the EU single market, while avoiding imposition of a 'hard border' that might incite a recurrence of conflict and destabilise the relative peace that has held since the end of "the Troubles".

With the economic performance of British businessmen before 1914 now viewed in a better informed and more balanced way, the critics turned to sociology to emphasise their position in the class structure, especially their supposed subordinate relationship to the aristocracy, and their desire to use their wealth to purchase landed estates, and acquire hereditary titles.