Entropic value at risk

Many risk measures have hitherto been proposed, each having certain characteristics.

The entropic value at risk (EVaR) is a coherent risk measure introduced by Ahmadi-Javid,[1][2] which is an upper bound for the value at risk (VaR) and the conditional value at risk (CVaR), obtained from the Chernoff inequality.

The EVaR can also be represented by using the concept of relative entropy.

Because of its connection with the VaR and the relative entropy, this risk measure is called "entropic value at risk".

The EVaR was developed to tackle some computational inefficiencies[clarification needed] of the CVaR.

Getting inspiration from the dual representation of the EVaR, Ahmadi-Javid[1][2] developed a wide class of coherent risk measures, called g-entropic risk measures.

be the set of all Borel measurable functions

The entropic value at risk (EVaR) of

results in By considering the equation (1), we see that which shows the relationship between the EVaR and the Chernoff inequality.

is the entropic risk measure or exponential premium, which is a concept used in finance and insurance, respectively.

The dual representation of the EVaR discloses the reason behind its naming.

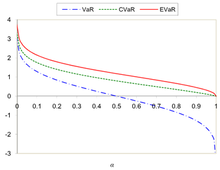

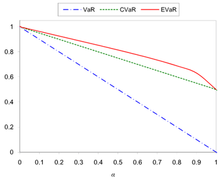

Figures 1 and 2 show the comparing of the VaR, CVaR and EVaR for

-dimensional real random vector with a known probability distribution and the function

, problem (14) is computationally intractable even for simple cases.

are independent discrete random variables that take

the complexity of computing the objective function given in problem (13) is of order

while the computing time for the objective function of problem (14) is of order

For computing the objective function of problem (14) one needs about

years, whereas the evaluation of objective function of problem (13) takes about

Drawing inspiration from the dual representation of the EVaR given in (3), one can define a wide class of information-theoretic coherent risk measures, which are introduced in.

-entropic risk measure with divergence level

-entropic risk measure, which can be obtained from (16) by setting with

[4] The disciplined convex programming framework of sample EVaR was proposed by Cajas[5] and has the following form: where

the mean vector of assets, we can posed the minimization of the expected EVaR given a level of expected portfolio return

Applying the disciplined convex programming framework of EVaR to uncompounded cumulative returns distribution, Cajas[5] proposed the entropic drawdown at risk(EDaR) optimization problem.

is a variable that represent the uncompounded cumulative returns of portfolio and

is the matrix of uncompounded cumulative returns of assets.

For other problems like risk parity, maximization of return/risk ratio or constraints on maximum risk levels for EVaR and EDaR, you can see [5] for more details.

The advantage of model EVaR and EDaR using a disciplined convex programming framework, is that we can use softwares like CVXPY [7] or MOSEK[8] to model this portfolio optimization problems.

EVaR and EDaR are implemented in the python package Riskfolio-Lib.