Economy of Europe

[17] In the International Comparison Program 2021, the Commonwealth of Independent States (CIS) region was linked through the standard global core list approach, unlike in ICP 2017.

"[21] Prior to World War II, Europe's major financial and industrial states were the United Kingdom, France and Germany.

Peace did not come to Yugoslavia for a decade, and by 2003, there were still many NATO and EU peacekeeping troops present in Bosnia and Herzegovina, North Macedonia, and Kosovo.

In early 2004, 10 mostly former communist states joined the EU in its biggest ever expansion, enlarging the union to 25 members, with another eight making associated trade agreements.

The Eurozone as a whole had become more stable, however problems in Greece and slow recovery in Italy and in Iberia (Spain and Portugal) continue in keeping growth in the Euro area to a minimum.

[36] While many social and economic indicators have converged across EU regions, the global financial crisis resulted in a sharp divergence in unemployment rates.

[36] In 2016, the United Kingdom became the first nation to vote to leave the European Union since its modern iteration in the post-Cold War era, reducing the number of the said bloc's membership down to 27 member states for the time being.

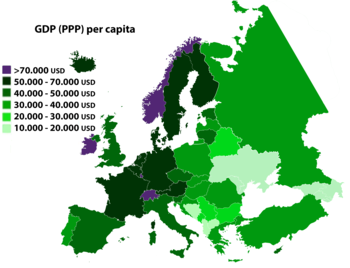

European countries with a long history of trade, a free market system, and a high level of development in the previous century are generally in the north and west of the continent.

They tend to be wealthier and more stable than countries congregated in the European East and South, even though the gap is converging, especially in Central and Eastern Europe, due to higher growth rates.

Former Western Bloc itself presents some living standards and development differences, with the greatest contrast seen between the Nordics (Norway, Denmark, Sweden, Finland) and Greece, Portugal, Spain and Italy.

The Common Fisheries Policy is surrounded by an extensive system of rules (mainly consisting of quotas) to protect the environment from overfishing.

Despite these rules, the cod is becoming increasingly rare in the North Sea resulting in drastic shortages in countries such as Canada and the United Kingdom.

Strict fishing rules are the main reason for Norway and Iceland to stay out of the European Union (and out of the Common Fisheries Policy).

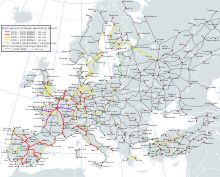

Most of the continent's industries are concentrated in the 'Blue Banana' (covering Southern England, the Benelux, western Germany, eastern France, Switzerland, and northern Italy).

This means that manufacturing has become less important and that jobs are moved to regions with cheaper labour costs (mainly China and Central and Eastern Europe).

Central Europe (Berlin, Saxony, the Czech Republic and Little Poland) was largely industrialised by 1850[54] but Eastern Europe (European Russia) begun industrialisation between 1890–1900 and intensified it during the communist regime (as the USSR), but it suffered from contraction in the 1990s when the inefficient heavy-industry-based manufacturing sector was crippled after the collapse of communism and the introduction of the market economy.

[55] The main products in European industry are automobiles, bicycles, rail, machinery, marine, aerospace equipment, food, chemical and pharmaceutical goods, software and electronics.

Demographics and rising demand for skills that are less common on the market, such as those needed to support digitalization activities, might contribute to the lack of competent workers.

[67][70] Intangible assets (R&D, software, training, and business processes) were invested in by firms in Central, Eastern and Southeastern Europe countries at a lower rate (24%) in 2022 than the EU average (37%).

[73][74][75] Europe's level of productive investment has lagged behind that of the United States - by two percentage points of GDP annually since 2010, according to European Commission data.

[76] In comparison to 2021, there is a significant increase in the proportion of enterprises citing energy prices as a limitation to investment (87%), particularly those considering it as a substantial obstacle (63%).

[71] Long-term hurdles to corporate investment continue to be energy prices, uncertainty, and a shortage of skills, with 83%, 78%, and 81% of enterprises citing these concerns as restraints, respectively.

[73][79] In 2022 - 2023, EU businesses were found increasingly unhappy with the cost of credit as monetary policy tightened and external finance conditions deteriorated.

Fixed investments and retail components, particularly the housing sector, contributed adversely, while credit demand was once again driven by corporate liquidity requirements (particularly for inventories and working capital).

Banks foresee an increase in non-performing loans (NPLs), which would hit the retail and business sectors in virtually all countries (excluding Albania).

[90] According to recent intelligence reported by GlobalData, the global Uncrewed Aerial Systems (UAS) market is projected to see a significant increase over the coming decade.

An estimated compound annual growth rate of 4.8% is expected, primarily owing to the swift rise in Europe's UAS market.

[94] Approximately 20% of parent banks in Central, Eastern, and South-Eastern Europe anticipate asset sales or strategic restructuring at the group level.

[94] International banking groups in Central, Eastern, and South-Eastern Europe mostly maintained their regional exposure over the six months leading to October 2024.

This fragmentation, along with increased movement of people since the Industrial Revolution, has led to a high level of cooperation between European countries in developing and maintaining transport networks.