Excise tax in the United States

Certain goods, such as gasoline, diesel fuel, alcohol, and tobacco products, are taxed by multiple governments simultaneously.

[1] Some excise taxes are collected from the producer or retailer and not paid directly by the consumer, and as such, often remain "hidden" in the price of a product or service rather than being listed separately.

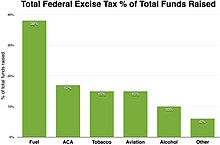

Excise taxes for the Affordable Care Act (ACA) raised $16.3 billion in fiscal year 2015.

[3] Annual excise taxes totaling $3 billion were levied on importers and manufacturers of prescription drugs.

[6] A recent exception to this "state of being" principle is the "minimum essential coverage" tax under Internal Revenue Code section 5000A as enacted by the Patient Protection and Affordable Care Act (Public Law 111–148), whereby a tax penalty is imposed as an indirect tax on the condition of not having health insurance coverage; as reasoned by Chief Justice John Roberts in National Federation of Independent Business v. Sebelius: "it is triggered by specific circumstances.

Responding to an urgent need for revenue following the American Revolutionary War, after the ninth state ratified the U.S. Constitution in 1788 the newly elected First United States Congress passed, and President George Washington, signed the Tariff Act of July 4, 1789, which authorized the collection of tariff duties (customs) on imported goods.

Hamilton thought it was important to start the U.S. federal government out on a sound financial basis with good credit and a regular, easily collected source of revenue.

In addition to tariffs, low excise taxes were imposed to provide the federal government with some additional money to pay part of its operating expenses and to help redeem at full value U.S. federal debts and the debts the states had accumulated during the American Revolutionary War.

Congress set low excise taxes on only a few goods, such as whiskey, rum, tobacco, snuff and refined sugar.

The excise tax on whiskey was so despised by western farmers who had no easy way to transport their bulky grain harvests to market without converting them into alcohol that it led to the Whiskey Rebellion, which had to be quelled by President Washington calling up the militia and suppressing the rebellious farmers, all of whom were later pardoned.

When the United States public debt was finally paid off in 1834, President Andrew Jackson abolished the excise taxes and reduced the customs duties (tariffs) in half.

Excise taxes stayed essentially zero until the American Civil War brought a need for much more federal revenue.

The U.S. has expanded the definition of items on the excise tax lists as trusts for highways, airports, vaccines, black lung, oil spills, etc.

The price for which the item is ultimately sold is not generally considered in calculating the excise tax amount.

[22] An excise is imposed on listed specific taxable events or products and is usually not collected or paid directly by the consumer.

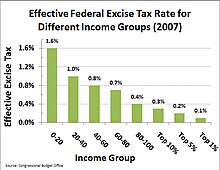

The producer can usually pass at least some of the excise tax burden to the consumer, the amount of which is added to the price of the product when it is sold.

The degree to which consumers and producers will share the burden, called tax incidence, depends upon the price elasticities of supply and demand.

Tariffs or customs duties on imported goods are essentially the only property taxes imposed by the U.S. federal government.

A customs duty or tariff is nominally separate from an excise tax for U.S. constitutional law purposes.

[25] Federal Trust Fund excise tax collections are often remitted to each state by complicated allocation plans.

The bulk of funding is for specific programs set up to channel aid to the states for various uses, such as providing capital for the nation's most heavily used roads, maintaining interstates, and fixing bridges.

Regular maintenance on non-interstate roads, including pothole patching and snowplowing, must be funded through other sources.

The Mass Transit Account, which gets its funding from a fraction of the excise taxes imposed on fuels, etc., has similar restrictions.

§ 5891, relating to such things as luxury passenger automobiles, heavy trucks and trailers, "gas guzzler" vehicles, tires, petroleum products, coal, vaccines, recreational equipment, firearms (see National Firearms Act), communications services (see telephone federal excise tax), air transportation, policies issued by foreign insurance companies, wagering, water transportation, removal of hard mineral resources from deep seabeds, chemicals, certain imported substances, non-deductible contributions to certain employer plans, and many other subjects.

Excise duties usually have one or two purposes: to raise revenue and to discourage particular behavior or purchase of specific items.

Specifically, the federal government uniformly charges an excise tax of $1.01 for a standard pack of 20 cigarettes.

[29] With Hawaii's industry heavily dependent on tourism and tourist spending, the state regularly raises nearly half its government revenues through the imposition of the GET.

[31] The Bureau of Alcohol, Tobacco, Firearms and Explosives (ATF), formed in 1886, is a federal law enforcement organization within the United States Department of Justice (DOJ).

[32] Its responsibilities include the investigation and prevention of federal offenses involving the unlawful use, manufacture, and possession of firearms and explosives; acts of arson and bombings; and illegal manufacturing and trafficking of alcohol and tobacco products that avoid paying the federal excise taxes on these products.