Form 1042

[1] Every withholding agent or intermediary, whether US or foreign, who has control, receipt, custody, disposal or payment of any fixed or determinable, annual or periodic US source income over foreign persons, must file these forms with the IRS.

[1] If Form 1042 and/or Form 1042-S are filed late, or the tax isn't paid or deposited when due, the filer may be liable for penalties, unless they show that the failure to file or pay was due to reasonable cause and not willful neglect.

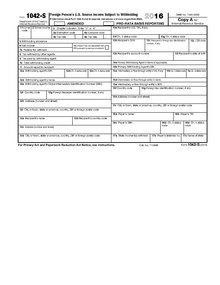

Source Income Subject to Withholding", is used to report any payments made to foreign persons.

Non-resident alien employees receive a completed version of this form from their withholding agent if they have one.

[9] A common use of Form 1099-MISC is to report amounts paid by a business to a non-corporate US resident independent contractor for services.

There are a few important differences: Form W-2 is issued for work done as an employee to all US citizens and residents and is issued to foreign employees who either don't fall under a tax treaty, or whose earnings exceed allowable maximums of a tax treaty.