Gold standard

[8] The gold standard was largely abandoned during the Great Depression before being reinstated in a limited form as part of the post-World War II Bretton Woods system.

[2] According to economist Michael D. Bordo, the gold standard has three benefits that made its use popular during certain historical periods: "its record as a stable nominal anchor; its automaticity; and its role as a credible commitment mechanism.

For millennia it was silver, not gold, which was the real basis of the domestic economies: the foundation for most money-of-account systems, for payment of wages and salaries, and for most local retail trade.

[22] Gold functioning as currency and unit of account for daily transactions was not possible due to various hindrances which were only solved by tools that emerged in the 19th century, among them: The earliest European currency standards were therefore based on the silver standard, from the denarius of the Roman Empire to the penny (denier) introduced by Charlemagne throughout Western Europe, to the Spanish dollar and the German Reichsthaler and Conventionsthaler which survived well into the 19th century.

Gold functioned as a medium for international trade and high-value transactions, but it generally fluctuated in price versus everyday silver money.

Since the Indian system (gold exchange standard implemented in 1893) has been perfected and its provisions generally known, it has been widely imitated both in Asia and elsewhere ... Something similar has existed in Java under Dutch influences for many years ...

Various international monetary conferences were called up until 1892, with various countries actually pledging to maintain the limping standard of freely circulating legacy silver coins in order to prevent the further deterioration of the gold–silver ratio which reached 20 in the 1880s.

Developed economies deciding to buy or sell domestic assets to international investors also turned out to be more effective in influencing gold flows than the self-correcting mechanism predicted by Hume.

[17] Some countries had limited success in implementing the gold standard even while disregarding such "rules of the game" in its pursuit of other monetary policy objectives.

Inside the Latin Monetary Union, the Italian lira and the Spanish peseta traded outside typical gold-standard levels of 25.02–25.42F/£ for extended periods of time:[36] In the 1780s, Thomas Jefferson, Robert Morris and Alexander Hamilton recommended to Congress that a decimal currency system be adopted by the United States.

In the decade before the Civil War net exports were roughly constant; postwar they varied erratically around pre-war levels but fell significantly in 1877 and became negative in 1878 and 1879.

A run on sterling caused Britain to impose exchange controls that fatally weakened the standard; convertibility was not legally suspended, but gold prices no longer played the role that they did before.

The newly created Federal Reserve intervened in currency markets and sold bonds to "sterilize" some of the gold imports that would have otherwise increased the stock of money.

[49] By fixing the price at a level which restored the pre-war exchange rate of US$4.86 per pound sterling, as Chancellor of the Exchequer, Churchill is argued to have made an error that led to depression, unemployment and the 1926 general strike.

[32] In the summer of 1931, a Central European banking crisis led Germany and Austria to suspend gold convertibility and impose exchange controls.

The Austrian and German experiences, as well as British budgetary and political difficulties, were among the factors that destroyed confidence in sterling, which occurred in mid-July 1931.

[51] Loans from American and French central banks of £50 million were insufficient and exhausted in a matter of weeks, due to large gold outflows across the Atlantic.

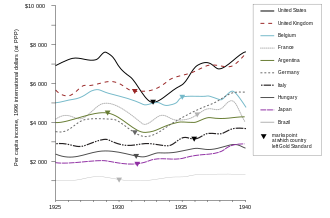

[60] Economists, such as Barry Eichengreen, Peter Temin and Ben Bernanke, allocate at least part of the blame for prolonging the economic depression on the gold standard of the 1920s.

[66] A 2024 study in the American Economic Review found that for a sample of 27 countries, leaving the gold standard helped states to recover from the Great Depression.

Other causal factors, or factors in the prolongation of the Great Depression include trade wars and the reduction in international trade caused by barriers such as Smoot–Hawley Tariff in the U.S.[73][74] and the Imperial Preference policies of Great Britain, the failure of central banks to act responsibly,[75] government policies designed to prevent wages from falling, such as the Davis–Bacon Act of 1931, during the deflationary period resulting in production costs dropping slower than sales prices, thereby injuring business profits[76] and increases in taxes to reduce budget deficits and to support new programs such as Social Security.

[81] According to Federal Reserve Chairman Marriner Eccles, the root cause was the concentration of wealth resulting in a stagnating or decreasing standard of living for the poor and middle class.

This development came after the Zimdollar crashed based on official rate from US$1:ZWL2.50 at introduction to US$1:ZWL30,672.42 on 5 April 2024, whilst parallel market was trading at US$1:ZWL42,500 at the time of removal.

Representative money and the gold standard protect citizens from hyperinflation and other abuses of monetary policy, as were seen in some countries during the Great Depression.

A poll of 39 prominent U.S. economists conducted by the IGM Economic Experts Panel in 2012 found that none of them believed that returning to the gold standard would improve price-stability and employment outcomes.

The panel of polled economists included past Nobel Prize winners, former economic advisers to both Republican and Democratic presidents, and senior faculty from Harvard, Chicago, Stanford, MIT, and other well-known research universities.

[133] Former U.S. Federal Reserve Chairman Alan Greenspan acknowledged he was one of "a small minority" within the central bank that had some positive view on the gold standard.

[138] In 2011 the Utah legislature passed a bill to accept federally issued gold and silver coins as legal tender to pay taxes.

[139] As federally issued currency, the coins were already legal tender for taxes, although the market price of their metal content currently exceeds their monetary value.

[141] In 2013, the Arizona Legislature passed SB 1439, which would have made gold and silver coin a legal tender in payment of debt, but the bill was vetoed by the Governor.

[142] In 2015, some Republican candidates for the 2016 presidential election advocated for a gold standard, based on concern that the Federal Reserve's attempts to increase economic growth may create inflation.