Great Recession in the United States

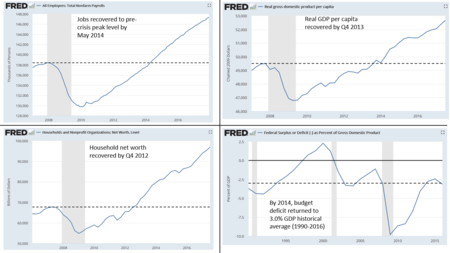

While the recession officially lasted from December 2007 to June 2009, it took many years for the economy to recover to pre-crisis levels of employment and output.

This slow recovery was due in part to households and financial institutions paying off debts accumulated in the years preceding the crisis[1] along with restrained government spending following initial stimulus efforts.

[11] After the Great Depression of the 1930s, the American economy experienced robust growth, with periodic lesser recessions, for the rest of the 20th century.

[14] The financial sector sharply expanded, in part because investment banks were going public, bringing them vast sums of stockholder capital.

Deregulation also precipitated financial fraud - often tied to real estate investments - sometimes on a grand scale, such as the savings and loan crisis.

[18] A chief economist at Standard & Poor's said in March 2008 he had projected a worst-case-scenario in which the country would endure a double-dip recession, in which the economy would briefly recover in the summer 2008, before plunging again.

[citation needed] Under this scenario, the economy's total output, as measured by the gross domestic product (GDP), would drop by 2.2 percentage points, making it among the worst recessions in the post World War II period.

[citation needed] The former head of the National Bureau of Economic Research said in March 2008 that he believed the country was then in a recession, and it could be a severe one.

[citation needed] A number of private economists generally predicted a mild recession ending in the summer of 2008 when the economic stimulus checks going to 130 million households started being spent.

A chief economist at Moody's predicted in March 2008 that policymakers would act in a concerted and aggressive way to stabilize the financial markets, and that the economy would suffer, but not enter a prolonged and severe recession.

[citation needed] It takes many months before the National Bureau of Economic Research, the unofficial arbiter of when recessions begin and end, would make its own ruling.

[20] However, this estimate has been disputed by analysts who argue that if inflation is taken into account, the GDP growth was negative for those two quarters, making it a technical recession.

[21] In a May 9, 2008 report, the chief North American economist for investment bank Merrill Lynch wrote that despite the GDP growth reported for the first quarter of 2008, "it is still reasonable to believe that the recession started some time between September and January", on the grounds that the National Bureau of Economic Research's four recession indicators all peaked during that period.

[25] On the other hand, Martin Feldstein, who headed the National Bureau of Economic Research and served on the group's recession-dating panel, said he believed the U.S. was in a very long recession and that there was nothing the Federal Reserve could do to change it.

[26] In a CNBC interview at the end of July 2008, Alan Greenspan said he believed the U.S. was not yet in a recession, but that it could enter one due to a global economic slowdown.

[28] In March 2008, financier Warren Buffett stated in a CNBC interview that by a "common sense definition", the U.S. economy was already in a recession.

Examples of vulnerabilities in the private sector included: financial institution dependence on unstable sources of short-term funding such as repurchase agreements or Repos; deficiencies in corporate risk management; excessive use of leverage (borrowing to invest); and inappropriate usage of derivatives as a tool for taking excessive risks.

[47] On January 4, 2009, Nobel Memorial Prize–winning economist Paul Krugman wrote, "This looks an awful lot like the beginning of a second Great Depression.

One of the frightening aspects how deep the recession would go, which is one reason Congress passed and President Obama signed the American Recovery and Reinvestment Act (ARRA) in January 2009.

Known as "The Stimulus", ARRA was a roughly $800 billion mix of tax cuts (about one-third) and spending programs (about two-thirds) with the primary impact spread over three years.

[52] The wider measure of unemployment ("U-6") which includes those employed part-time for economic reasons or marginally attached to the labor force rose from 8.4% pre-crisis to a peak of 17.1% in October 2009.

Insurer AIG, which had guaranteed many of the liabilities of these and other banks around the globe through derivatives called credit default swaps, also was bailed out and taken over by the government at an initial cost exceeding $100 billion.

[55] A timeline of some of the significant events in the crisis from 2007 to 2008 includes: The year 2008, as of September 17, had seen 81 public corporations file for bankruptcy in the United States, already higher than the 78 for all of 2007.

On September 17, 2008, Federal Reserve chairman Ben Bernanke advised Secretary of the Treasury Henry Paulson that a large amount of public money would be needed to stabilize the financial system.

[66] The Treasury Secretary also indicated that money funds would create an insurance pool to cover themselves against losses and that the government would buy mortgage-backed securities from banks and investment houses.

[66] Initial estimates of the cost of the Treasury bailout proposed by the Bush administration's draft legislation (as of September 19, 2008) were in the range of $700 billion[67] to $1 trillion U.S.

[77] The Securities and Exchange Commission announced the termination of short-selling of 799 financial stocks, as well as action against naked short selling, as part of its reaction to the mortgage crisis.

Research indicates recovery from financial crises can be protracted, with lengthy periods of high unemployment and substandard economic growth.

[2] Several key economic variables (e.g., Job level, real GDP per capita, stock market, and household net worth) hit their low point (trough) in 2009 or 2010, after which they began to turn upward, recovering to pre-recession (2007) levels between late 2012 and May 2014 (close to Reinhart's prediction), which marked the recovery of all jobs lost during the recession.