Higher education bubble in the United States

[4] Without safeguards in place for funding and loans, the government risks creating a moral hazard in which schools charge students expensive tuition fees without offering them marketable skills in return.

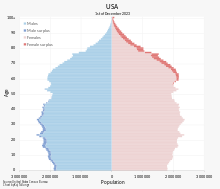

[7][8][9][10] There is a further concern that having an excess supply of college graduates exacerbates political instability,[11][12][13] historically linked to having a bulge in the number of young degree holders.

[23] Others believe number of institutions of higher education in the United States will fall in the 2020s and beyond, citing reasons of demographic decline, poor outcomes, economic problems, and changing public interests and attitudes.

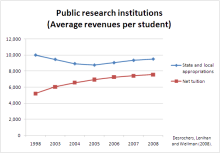

[29][30] The Federal Reserve Bank of St. Louis noted in 2019 that investment in higher education has reached a point of diminishing marginal returns.

[46] Due to the GI Bill and the population boom after World War II, demand for higher education grew significantly during the latter half of the twentieth century, making it one of the major growth sectors for the American economy.

In addition, college rankings were partially driven by spending levels,[50] and higher tuition was also correlated with increased public perceptions of prestige.

[51] From the 1980s to the 2010s, demand for higher education increased, especially after the Great Recession of 2007–2009 when Americans flocked back to school in order to adapt to the new economy.

Data has shown that although the wage premium (the difference in incomes between those with a four-year college degree and those with only a high school diploma) has increased dramatically since the 1970s, so has the 'debt load' incurred by students due to the tuition inflation.

[23] Economists Michael Spence and Joe Stiglitz suggest that much of the worth of a university degree lies not in the skills acquired, but rather market signaling.

[66] In 2019, a report from the Federal Reserve Bank of St. Louis using data from the 2016 Survey of Consumer Finances concluded that after controlling for race and age cohort, families with heads of household with post-secondary education who were born before 1980 benefited from wealth and income premiums, while for families with heads of household with post-secondary education but born after 1980 the wealth premium has weakened to point of statistical insignificance due in part to the rising cost of college.

Moreover, although the income premium remains positive, it had declined to historic lows with more pronounced downward trajectories with heads of household with postgraduate degrees.

People became increasingly concerned about debts and deficits, forcing institutions to prove their worth by clarifying how much money from which industry and company funded research, and how much it would cost to attend.

[41][72] As of 2023, seven states had passed legislation requiring the disclosure of data on the worth of a university degree, such as students' loan payment and post-graduation employment.

[6] Another reason for the decline of interest in the humanities and liberal arts is the fact that many prospective students avoided them for fear of loss of parental support,[73] and the perceived intolerance towards conservatives on college campuses, which tend to be dominated by left-wing faculty members,[73] though the details are not as simple as they first appear.

[74] On the other hand, in the life sciences, the number of students or researchers interested in a postdoctoral fellowship had plummeted thanks to a boom in the biotechnology industry, which has had an insatiable appetite for talents and is willing to pay much higher than universities.

[75][76] In physics and engineering, which are traditionally male-dominated fields, enrollments had also fallen since 2020, as white men lost interest in higher education.

[77] Colleges and universities have been criticized for offering degree programs that fail to provide students with relevant skills in the labor market after graduation,[78] as well as grade inflation by lowering standards both for admission and coursework.

[80] Due to popular demand, the cost of higher education has grown at a rate faster than inflation between the late 20th and early 21st centuries.

[83] The 2010s were a turbulent period for higher education in the United States, as small private colleges from across the country faced deep financial trouble as they had to make high tuition discounts in order to attract students at a time when higher education costs were increasing, regulation was becoming more stringent, and demographic challenges were becoming more severe[86][46] By the early 2020s, enrollments were declining at a growing rate as the number of high-school graduates continued to fall.

[87] A 2019 analysis by Moody's Investor Services estimated that about 20% of all small private liberal arts colleges in the United States were in serious financial trouble.

[43] In fact, they were closing at an accelerating rate, and for-profit institutions were the hardest hit, as they were targeted by stricter regulations from the Obama administration.

[98] Numerous institutions, including elite ones, suspended graduate programs in the humanities and liberal arts due to low student interest and dim employment prospects.

[111] Before Biden, President Donald Trump signed a 2017 executive order expanding federal funding for apprenticeship programs which had bipartisan support.

[109] In 2022, President Biden announced an initiative aimed at expanding apprenticeship and work-based training programs in K–12 public schools in order to create a competitive and skilled workforce.

[112] On the other hand, Biden's student loan relief plan worth $400 billion was struck down by the Supreme Court of the United States.

[113] In the aftermath of the COVID-19 pandemic, colleges and universities saw an increase in the number of faculty members leaving academia, citing low pay, stressful work environments, heavy workloads, lack of administrative support, and occupational burnout as reasons for their decisions.

[119] Nevertheless, dependency on foreign students threatened the future of many American schools, which had hitherto been assuming that the number of international applicants would keep growing.

Moreover, as the birth rates of teenagers and the lower classes continues to fall while women with higher incomes and education are having more children, students in the future will be less likely to have to rely on loans.

Because the asset acquired through college attendance – a higher education – cannot be sold but only rented through wages, there is no similar mechanism that would cause an abrupt collapse in the value of existing degrees.

[131][132] As evidence for this hypothesis, it has been suggested that returning bankruptcy protections (and other standard consumer protections) to student loans would cause lenders to be more cautious, thereby causing a sharp decline in the availability of student loans, which, in turn, would decrease the influx of dollars to colleges and universities, who, in turn, would have to sharply decrease tuition to match the lower availability of funds.