History of the euro

At this time memories of the Latin Monetary Union[2] involving principally France, Italy, Belgium and Switzerland and which, for practical purposes, had disintegrated following the First World War, figured prominently in the minds of policy makers.

The European Council tasked Pierre Werner, Prime Minister of Luxembourg, with finding a way to reduce currency exchange rate volatility.

His report was published in October 1970 and recommended centralisation of the national macroeconomic policies entailing "the total and irreversible fixing of parity rates and the complete liberation of movements of capital".

In 1971, US President Richard Nixon removed the gold backing from the US dollar, causing a collapse in the Bretton Woods system that managed to affect all of the world's major currencies.

France, Italy and the European Commission backed a fully monetary union with a central bank, which British Prime Minister Margaret Thatcher opposed.

[9] The Delors report[10] of 1989 set out a plan to introduce the EMU in three stages and it included the creation of institutions such as the European System of Central Banks (ESCB), which would become responsible for formulating and implementing monetary policy.

Beginning the first of these steps, on 1 July 1990, exchange controls were abolished, thus capital movements were completely liberalised in the European Economic Community.

[15] They could not be set earlier, because the ECU depended on the closing exchange rate of the non-euro currencies (principally the pound sterling) that day.

In Finland, the Central Bank opened for an hour at midnight to allow citizens to exchange currency, while a huge euro pyramid decorated Syntagma Square in Athens.

Other countries noted the coming of the euro as well—Paris's Pont Neuf was decorated in EU colours, while in the northern German town of Gifhorn a sombre, symbolic funeral for the Deutsche Mark took place.

However, even after the official dates, they continued to be accepted for exchange by national central banks for varying periods—and indefinitely in Austria, Germany, Ireland, and Spain.

[37] Alan Greenspan in 2007 said the eurozone had profited from the euro's rise and claimed it was perfectly conceivable that it could trade equally or become more important than the US dollar in the future.

[41] Despite the recession, Estonia acceded to the eurozone and Iceland put in an EU application to join the euro, seeing it at the time as a safe haven.

The leaders hammered out a plan to confront the financial crisis which will involve hundreds of billions of euros of new initiatives to head off a feared meltdown.

Coordination against the crisis is considered vital to prevent the actions of one country harming another and exacerbating the bank solvency and credit shortage problems.

[citation needed] Despite initial fears by speculators in early 2009 that the stress of such a large recession could lead to the break-up of the eurozone, the euro's position actually strengthened as the year progressed.

[47][48][49] However, in June 2010, broad agreement was finally reached on a controversial proposal for member states to peer review each other's budgets prior to their presentation to national parliaments.

Although showing the entire budget to each other was opposed by Germany, Sweden and the UK, each government would present to their peers and the Commission their estimates for growth, inflation, revenue and expenditure levels six months before they go to national parliaments.

Despite speculation that the crisis in Greece could spread and that the euro might fail, some newer EU states from the 2004 enlargement joined the currency during the recession.

Participation in ERM II began on 28 June 2004[56] and on 11 July 2006 the Council of EU adopted a decision allowing Slovenia to join the euro area as from 1 January 2007, becoming the first nation from the former Socialist Federal Republic of Yugoslavia to do so.

The exchange rate between the euro and tolar had been set on 11 July 2006 at 239.640 SIT, but unlike the previous launches, cash and non-cash transactions were introduced simultaneously.

[67] On 16 May 2007, the Commissioner for Economic & Financial Affairs of the EU, Joaquín Almunia, recommended that Malta adopt the euro as scheduled, a decision later confirmed by the Council of Finance Ministers of 10 July 2007.

Celebrations reached climax on New Year's Eve with a firework display near the Grand Harbour area, several other activities had to be moved indoors because of the stormy weather that struck the island on that night.

[70] To assist the process of conversion to the euro, on 1 April 2008, the National Bank of Slovakia (NBS) announced their plan for withdrawal of the Slovak koruna notes and coins.

[72] On 7 May 2008, the European Commission approved the application and asked member states to endorse the bid during the EU finance ministers' meeting in July 2008.

The exchange rate between the euro and kuna had been set on 12 July 2022 at 7.5345 HRK and similar to the previous launch of Slovenia, cash and non-cash transactions were introduced simultaneously on the same day and date the country also entered the Schengen Area.

The chart below provides a full summary of all applying exchange-rate regimes for EU members, since the European Monetary System with its Exchange Rate Mechanism and the related new common currency ECU was born on 13 March 1979.

Sources: EC convergence reports 1996-2014, Italian lira, Spanish peseta, Portuguese escudo, Finnish markka, Greek drachma, Sterling The eurozone was born with its first 11 Member States on 1 January 1999.

In September 2011, a diplomatic source close to the euro adoption preparation talks between the seven remaining new Member States from Eastern Europe who had yet to adopt the euro (Bulgaria, Czech Republic, Hungary, Latvia, Lithuania, Poland and Romania), claimed that the monetary union (eurozone) they had thought they were going to join upon their signing of the accession treaty may very well end up being a very different union entailing much closer fiscal, economic and political convergence.

This changed legal status of the eurozone could potentially cause them to conclude that the conditions for their promise to join were no longer valid, which "could force them to stage new referendums" on euro adoption.

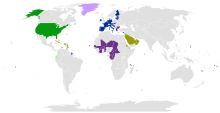

- European Union member states ( special territories not shown)

-

20 in the eurozone5 not in ERM II, but obliged to join the eurozone on meeting the convergence criteria ( Czech Republic , Hungary , Poland , Romania , and Sweden )

- Non–EU member states