Income in the United Kingdom

[2] In September 2023, Joseph Rowntree Foundation calculated that a single adult in the UK in 2023 needs at least £29,500 a year to have an acceptable standard of living, up from £25,000 in 2022.

29% of the UK population – which works out to 19.2 million people – belong to households that bring in below a minimum figure.

[5] The Survey of Personal Incomes (SPI) is a dataset from HM Revenue and Customs (HMRC) based on individuals who could be liable to tax.

[5][8] The Households Below Average Income (HBAI) dataset is based on the Family Resources Survey (FRS) from the Department for Work and Pensions (DWP).

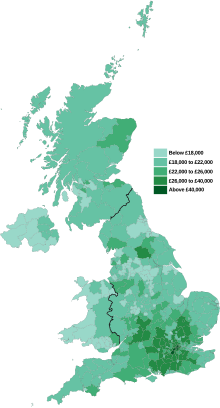

[8] According to the OECD the average household net-adjusted disposable income per capita is $27,029 a year (in USD, ranked 14/36 OECD countries), the average household net financial wealth per capita is estimated at $60,778 (in USD, ranked 8/36), and the average net-adjusted disposable income of the top 20% of the population is an estimated $57,010 a year, whereas the bottom 20% live on an estimated $10,195 a year giving a ratio of 5.6 (in USD, ranked 25/36).

[10] The 2013/14 HBAI reported that 15% of people had a relative low income (below 60% of median threshold) before housing costs.

The Office for National Statistics found that the median total wealth for individuals in Great Britain was estimated to be £125,000 between April 2018 and March 2020.

[13] The Institute for Fiscal Studies issued a report Archived 16 June 2008 at the Wayback Machine on the UK's highest earners in January 2008.

A summary of key findings is shown in the table below: The top 0.1% are 90% male and 50% of these people are in the 45 to 54 year age group.