International investment agreement

Countries concluding IIAs commit themselves to adhere to specific standards on the treatment of foreign investments within their territory.

[1] Provisions on compensation for losses incurred by foreign investors as a result of expropriation or due to war and strife usually also form a core part of such agreements.

Nevertheless, the assumption is that the enhanced protection formally offered to foreign investors through an IIA will encourage and promote cross-border investments.

Usually this gives investors the right to submit a case to an international arbitral tribunal when a dispute with the host country arises.

The conclusion of BITs has evolved from the second half of the 20th century onwards, and today these agreements constitute a key component of the contemporary international law on foreign investment.

"[2] While the basic content of BITs has largely remained the same over the years, focusing on investment protection as the core issue, matters reflecting public policy concerns (e.g. health, safety, essential security or environmental protection) have in recent years more frequently been incorporated into BITs.

[3] A typical BIT starts with a preamble that outlines the general intention of the agreement and provisions on its scope of application.

Moreover, BITs deal with the issue of expropriation or damage to an investment, determining how much and how compensation would be paid to the investor in such a situation.

In PTIAs, the section dealing with foreign investment forms only a small part of the treaty, usually encompassing one or two chapters.

Other issues dealt with in PTIAs are trade in goods and services, tariffs and non-tariff barriers, customs procedures, specific provisions pertaining to selected sectors, competition, intellectual property, temporary entry of people, and many more.

[8] The main purpose of international taxation agreements is to regulate how taxes imposed on the global income of multinational enterprises are distributed among countries.

The first era – from 1945 to 1989 – was characterized by disagreements among countries about the degree of protection that international law should offer to foreign investors.

The second era – from 1989 to today – is characterized by a generally more welcoming sentiment towards foreign investment, and a substantial increase in the number of BITs concluded.

By 2007 year-end, the entire number of IIAs had already surpassed 5,500,[11] and increasingly involved the conclusion of PTIAs with a focus beyond investment issues.

The current trend towards increased conclusions of IIAs among developing countries reflects the economic changes underlying international investment relations.

In line with their emerging role as outward investors and their improved economic competitiveness, developing countries are increasingly pursuing the dual interests of encouraging FDI inflows but also seeking to protect the investments of their companies abroad.

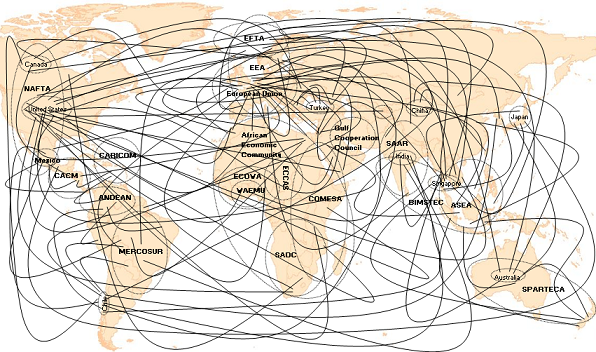

It is also multi-faceted, as an increasing number of IIAs include provisions on issues traditionally considered only distantly related to investment, such as trade, intellectual property, labor rights and environmental protection.

All of this makes managing the interaction among IIAs increasingly challenging for countries, particularly those in the developing world, and also complicates the negotiation of new agreements.

These attempts include the Havana Charter of 1948, the United Nations Draft Code of Conduct on Transnational Corporations in the 1980s, and the Multilateral Agreement on Investment (MAI) of the Organisation for Economic Co-operation and Development (OECD) in the 1990s.

None of these initiatives reached successful conclusion, due to disagreements among countries and, in case of the MAI, also in light of strong opposition by civil society groups.

As a result, current international investment rulemaking remains short of having a unified system based on a multilateral agreement.

By providing additional security and certainty under international law to investors operating in foreign countries, IIAs can encourage companies to invest overseas.

Amongst others, FDI can facilitate the inflows of capital and technology into host countries, help generate employment and have other positive spillover effects.

Accordingly, developing country governments seek to establish an adequate framework to encourage such inflows, amongst others through the conclusion of IIAs.

An additional burden arises from the growing number of investor-State disputes, which are increasingly lodged against governments from developing countries.

This organization's program on IIAs supports developing countries in their efforts to participate effectively in the complex system of investment rulemaking.

The guidelines are "a reaffirmation of the fundamental principles for investment set out by the business community in 1972 as essentials for further economic development."