Spillover (economics)

[2] Moreover, positive or negative impact often creates a social crisis or a shock in the market like booms or crashes.

[1] In the same way, the economic benefits of increased trade are the spillover effects anticipated in the formation of multilateral alliances of many of the regional nation states: e.g. SAARC (South Asian Association for Regional Cooperation), ASEAN (Association of South East Asian Nations).

19th century economists John Stuart Mill and Henry Sidgwick are credited with founding the early concepts related to spillover effects.

This occurs as consumers are effectively bidding for the remaining oil which is more scarce than before, forming a new equilibrium price in the market.

However, the key difference is that externalities are represented by social costs that are not reflected in a price change without government intervention.

An example is pollution caused by industrial plants, releasing smoke, carbon dioxide gas, oil wastewater, and other harmful waste materials into the atmosphere.

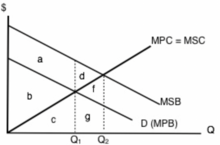

[8] Thus, in the diagram below, if the market was functioning properly by accounting for negative externalities, society would produce at quantity 2 (Q2) and a higher price (P2).

[8] In effect, this means the private benefit of a transaction (i.e., profit for a newly established business) is only part of the benefit accrued as an additional social cost (i.e., Surrounding cafes and restaurants gain more customers as employees from the newly established business buy lunch).

Firstly, it is important to identify and measure the presence of these externalities: for instance, the spillover effects which result from the process of production often necessitate robust data collection and analysis.

In order to assign a monetary value to the spillover effects of production it might be necessary to estimate such variables as healthcare costs from pollution or the value of clean water access.

MRIO is one of the categories of analysis which combines internationally harmonized input-output tables and trade statistics for sectors or groups of products or services of environmental use (e.g. land, water, timber), pollution (e.g. reactive nitrogen), or socioeconomis impacts (e.g. child labor, labor accidents, gender pay gap).

The disadvantage could be the fact that MRIO does not consider context-specific technologies, efficiencies or resource- or pollution- intensities but instead use average impacts.

So, MRIO methods are best suited to asssessing spillover effects of aggregate sectors or product groups at country level.

[9] MFA is based on the quantification and measuring of matter and substances in relation to the processes in a system such as a city or country.

[11] Using the MRIO trade data, environmental research, and industrial ecology, the Global Commons Stewardship Index features a global ranking and detailed features for ten countries and regions (the US, the EU, China, India, Japan, South Korea, Indonesia, the Philippines, Brazil and Indonesia) alongside sector-specific analyses of spillovers embodied in trade flows.

Economists debate the exact cause of the Great Depression however, it is mostly regarded as a confluence of events including the stock market crash of 1929, banking panics and monetary contraction, decreased international lending and tariffs.

One study shows that alternative energy stocks in French and German exhibit abnormal returns during the event window.

It has been shown that during 20-day period immediately following the accident, shareholders earned, on average, significant negative anbormal returns.

The global economy has become more interdependent in the 21st century as globalisation has enhanced countries' reliance on other parts of the world for economic growth.

Therefore, when the emergence of the pandemic forced countries to close their borders, this had a spillover effect, creating an economic shortfall.

Due to the fact that many industrial plants were shut down because of the lockdown measures, pollution fell all over the world significantly.

[20][21] There are opposing views on the aggregate impact of globalisation as having either positive or negative spillover effects for the global economy.

However studies by[23] find that despite there being evidence that there is a positive correlation between trade openness and carbon dioxide emissions (negative externality), there could also exist benefits from globalisation impacting the environment through factors including spread of technology and knowledge beyond borders.

As banks granted loans to borrowers with a high chance of default, banks suffered from liquidity risk which led to significant macroeconomic impacts including losses for shareholders across all markets, significantly increased unemployment, bailouts from the Government and low investor and consumer confidence.

Data shows that China trading with more advanced economies has increased its access to new technology and information leading to improved competitiveness in global markets.

[26] Firms who seek to minimise costs in supply chains by using resources from overseas have been shown to invest in local infrastructure.

This dynamic is common as firms from advanced economies expand their production base overseas to take advantage of cheaper labor and capital costs.

Around this production site is the positive spillover of increased investment in local transport infrastructure as well as a food district for the workers.

Even North Korea as a closed-off economy has begun to feel the spillover effects from intermittent Chinese slowdowns.