Invesco QQQ

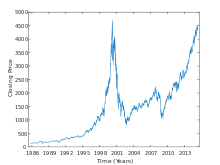

[1][2] Price of shares declined more than 80% due to the collapse of the Dot-com bubble.

[6] QQQM, for instance, offers a lower share price than QQQ and is marketed towards retail investors, as opposed to institutional investors.

[7] Scion Asset Management, the investment firm run by Michael Burry, established a bet against the performance of QQQ in August 2023.

[8] As of August 2023, the fund had $200 billion in assets under management,[1] and among its top holdings were Apple, Microsoft, and Amazon.

[9] A portion of the fund's assets under management is charged to investors as a fee (currently 0.20% per annum), a portion of which is used to purchase advertising for the fund.