Land value tax

[1][5][6] Economists since Adam Smith and David Ricardo have advocated this tax because it does not hurt economic activity, and encourages development without subsidies.

[7] A low-rate land value tax is currently implemented throughout Denmark,[8] Estonia, Lithuania,[9] Russia,[10] Singapore,[11] and Taiwan;[12] it has also been applied to lesser extents in parts of Australia, Germany, Mexico (Mexicali), and the United States (e.g., Pennsylvania[13]).

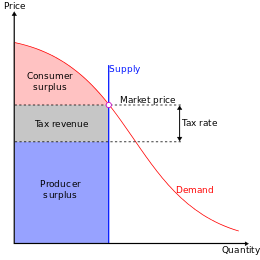

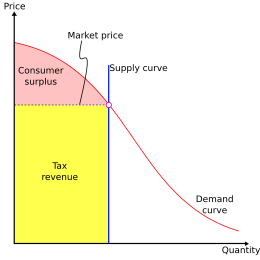

LVT is said to be justified for economic reasons because it does not deter production, distort markets, or otherwise create deadweight loss.

[citation needed] Real estate bubbles direct savings towards rent-seeking activities rather than other investments and can contribute to recessions.

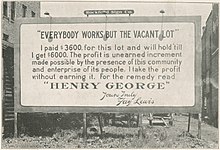

Advocates claim that LVT reduces the speculative element in land pricing, thereby leaving more money for productive capital investment.

Landowners often possess significant political influence, which may help explain the limited spread of land value taxes so far.

In a 1796 United States Supreme Court opinion, Justice William Paterson said that leaving the valuation process up to assessors would cause bureaucratic complexities, as well as non-uniform procedures.

[28] Murray Rothbard later raised similar concerns, claiming that no government can fairly assess value, which can only be determined by a free market.

LVT is less vulnerable to tax evasion, since land cannot be concealed or moved overseas and titles are easily identified, as they are registered with the public.

[48] The philosophies and concepts underpinning land value taxation were discussed in ancient times, stemming from taxes on crop yield.

A participant in the Radical Movement, Thomas Paine contended in his Agrarian Justice pamphlet that all citizens should be paid 15 pounds at age 21 "as a compensation in part for the loss of his or her natural inheritance by the introduction of the system of landed property."

Thomas Spence advocated a similar proposal except that the land rent would be distributed equally each year regardless of age.

[57] Adam Smith, in his 1776 book The Wealth of Nations, first rigorously analyzed the effects of a land value tax, pointing out how it would not hurt economic activity, and how it would not raise contract rents.

[7] This book significantly influenced land taxation in the United States and other countries, including Denmark, which continues grundskyld ('ground duty') as a key component of its tax system.

[67] After 1945, the Labour Party adopted the policy, against substantial opposition, of collecting "development value": the increase in land price arising from planning consent.

[citation needed] This was one of the provisions of the Town and Country Planning Act 1947, but it was repealed when the Labour government lost power in 1951.

[citation needed] Senior Labour figures in recent times have advocated an LVT, notably Andy Burnham in his 2010 leadership campaign, former Leader of the Opposition Jeremy Corbyn, and Shadow Chancellor John McDonnell.

[70] Pigou wrote an essay in favor of the land value tax, calling it "an exceptionally good object for taxation."

"Believe it or not, urban economics models actually do suggest that Georgist taxation would be the right approach at least to finance city growth.

It is what property owners and rentiers fear most of all, as land, subsoil resources and natural monopolies far exceed industrial capital in magnitude.

"Conventional macroeconomics lacks a warranted explanation of the major business cycle, while the Austrian and geo-economic Georgist schools have incomplete theories.

A geo-Austrian synthesis, in contrast, provides a potent theory consistent with historical cycles and with explanations about the root causes.

The Australian Capital Territory moved to adopt this system and planned to reduce stamp duty by 5% and raise land tax by 5% for each of twenty years.

[85] Gary B. Nixon (2000) stated that the rate never exceeded 2% of land value, too low to prevent the speculation that led directly to the 1913 real estate crash.

[91][92] Hong Kong is unique in a way because the government owns virtually all the land and allows for long term leases which is how they make their income off property.

[11] South Korea has an aggregate land tax that is levied annually based on an individual's landholding value across the whole country.

Earlier Georgist politicians included Patrick O'Regan and Tom Paul (who was Vice-President of the New Zealand Land Values League).

Lloyd George believed that relating national defence to land tax would both provoke the opposition of the House of Lords and rally the people round a simple emotive issue.

[116] The government responded by announcing "a comprehensive economic evaluation of the possible impact of moving to a land value taxation basis".

"[125] In 2009, Glasgow City Council resolved to introduce LVT by saying "the idea could become the blueprint for Scotland's future local taxation".