Tax incidence

[1] The concept of tax incidence is used in political science and sociology to analyze the level of resources extracted from each income social stratum in order to describe how the tax burden is distributed among social classes.

That allows one to derive some inferences about the progressive nature of the tax system, according to principles of vertical equity.

[citation needed] In competitive markets, firms supply a quantity of the product such that the price of the good equals marginal cost (supply curve and marginal cost curve are indifferent).

The point on the initial supply curve with respect to quantity of the good after taxation represents the price (from which the part of the tax is subtracted

While the demand curve moved by specific tax is parallel to the initial, the demand curve shifted by ad valorem tax is touching the initial, when the price is zero and deviating from it when the price is growing.

When the tax incidence falls on the farmer, this burden will typically flow back to owners of the relevant factors of production, including agricultural land and employee wages.

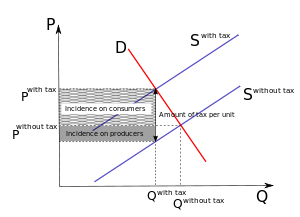

Compared to previous phenomena, elasticity of the demand and supply curve is an essential feature that predicts how much the consumers and producers will be burdened in the specific case of taxation.

Most markets fall between these two extremes, and ultimately the incidence of tax is shared between producers and consumers in varying proportions.

An example of the perfect elastic supply curve is the market of the capital for small countries or businesses.

[5] The other factors that might affect tax incidence are the difference between the short-run and long-run and between open and closed economies.

Thus it does not matter, whether the tax is imposed on supplier (households) or companies, which demand the labor as a factor of production.

So, if the tax is levied of this type of the market, it reduces the wages and therefore the quantity of labor rises.

Elasticity of the curves is still the essential factor that predicts the size of the tax burden levied on consumers and producers.

In general, the steeper the marginal cost curve, the smaller the observed change in output after taxation.

[8] In a closed economy model, the state uses the taxes it collects to buy goods or pay transfers to households and businesses.

Consequently, not only tax payments should be taken into account in the analysis, but also at the same time the gains of utility for the private sector associated with government spending.

the question of the optimum scale of government activity—is the subject of political economy and public finance.

These are class distinctions concerning the distribution of costs and are not addressed in current tax incidence models.

Yet the tax levy to support this effort falls primarily on American producers and consumers.

Corporations simply move out of the tax jurisdiction but still receive the property rights enforcement that is the mainstay of their income.

Specific incidence can thus be justified in the context of a partial analysis that looks at a single market rather than the economy as a whole.

The advantage of dealing with specific incidence lies in methodology because the partial analytical treatment of a single market is more straightforward than dealing with macroeconomic models, and in many cases, the findings obtained are consistent with those that would result from a macroeconomic analysis.

[10] Consider a 7% import tax applied equally to all imports (oil, autos, hula hoops, and brake rotors; steel, grain, everything) and a direct refund of every penny of collected revenue in the form of a direct egalitarian "Citizen's Dividend" to every person who files income tax returns.

The actual cost of the tax will be borne by whichever party (producers or consumers) has the more inelastic demand (see earlier section on relative elasticities), regardless of whether consumers buy domestic or foreign goods, and regardless of where the producers make their goods.

When tax revenues grow at a slower rate than the GDP of a country, the tax-to-GDP ratio drops.

For example, imposing a $1,000-per-gallon milk tax will raise no revenue (because legal milk production will stop), but this tax will cause substantial economic harm (lost consumer surplus and lost producer surplus).

The tax burden analysis aims to describe how different social classes contribute to the public sector.

[2] In the United States, the analysis regarding how the tax burden affects each of its social classes is conducted regularly.

The Congressional Budget Office presents a series of reports showing the share of all federal taxes paid by taxpayers at the same point in the income distribution.

Their data for 2017 shows the following: Assessing tax incidence is a major economics subfield within the field of public finance.