Marginal product of capital

[1] It is a feature of the production function, alongside the labour input.

The marginal product of capital (MPK) is the additional output resulting, ceteris paribus ("all things being equal"), from the use of an additional unit of physical capital, such as machines or buildings used by businesses.

The marginal product of capital (MPK) is the amount of extra output the firm gets from an extra unit of capital, holding the amount of labor constant:

The decision of increasing the production is only beneficial if the MPK is higher than the cost of capital of each additional unit.

[3] This concept equals the reciprocal of the incremental capital-output ratio.

Mathematically, it is the partial derivative of the production function with respect to capital.

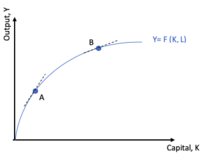

One of the key assumptions in economics is diminishing returns, that is the marginal product of capital is positive but decreasing in the level of capital stock, or mathematically

If the quantity of labor input, L, is hold fixed, the slope of the curve at any point resemble the marginal product of capital.

[4] Consider a furniture firm, in which labour input, that is, the number of employees is given as fixed, and capital input is translated in the number of machines of one of its factories.

This is justified by the fact that there is not enough employees to work with the extra machines, so the value that these additional units bring to the company, in terms of output generated, starts to decrease.

In a perfectly competitive market, a firm will continue to add capital until the point where MPK is equal to the rental rate of capital, which is called equilibrium point.

According to the neoclassical model, firms invest if the rental price is greater than the cost of capital, and they disinvest if the rental price is less than the cost of capital.

Thus, the profit of the firm will reach its maximum point when MRPK = MCK.