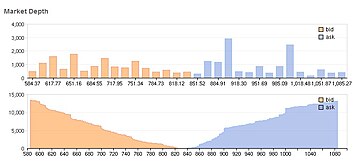

Market depth

In finance, market depth is a real-time list displaying the quantity to be sold versus unit price.

The list is organized by price level and is reflective of real-time market activity.

Mathematically, it is the size of an order needed to move the market price by a given amount.

If the market is deep, a large order is needed to change the price.

[1][2] In some cases, the term refers to financial data feeds available from exchanges or brokers.