Slippage (finance)

With regard to futures contracts as well as other financial instruments, slippage is the difference between where the computer signaled the entry and exit for a trade and where actual clients, with actual money, entered and exited the market using the computer's signals.

Knight and Satchell mention a flow trader needs to consider the effect of executing a large order on the market and to adjust the bid-ask spread accordingly.

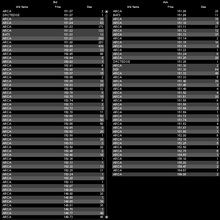

The associated image depicts the Level II (Market Depth) quotes of the SPY ETF (Exchange-Traded Fund) at a given instant in time.

At the $151.07 bid price point, there are 300 shares available (200 by the ARCA Market Maker and 100 by the DRCTEDGE).

To properly understand slippage, let's use the following example: Say, you (as a trader) wanted to purchase 20,000 shares of SPY right now.