Short squeeze

However, an unexpected piece of favorable news can cause a jump in the stock's share price, resulting in a loss rather than a profit.

Expensive borrow rates can increase the pressure on short sellers to cover their positions, further adding to the reflexive nature of this phenomenon.

This buying may proceed automatically, for example if the short sellers had previously placed stop-loss orders with their brokers to prepare for this possibility.

Alternatively, short sellers simply deciding to cut their losses and get out (rather than lacking collateral funds to meet their margin) can cause a squeeze.

Short squeezes are more likely to occur in stocks with relatively few traded shares and commensurately small market capitalization and float.

[7] Short squeezes can also be facilitated by the availability of inexpensive call options on the underlying security because they add considerable leverage.

The resulting runup in share price was accompanied by frenetic short selling of Northern Pacific by third parties.

On May 8, it became apparent that uncommitted NP shares were insufficient to cover the outstanding short positions, and that neither Hill and Morgan nor Harriman were willing to sell.

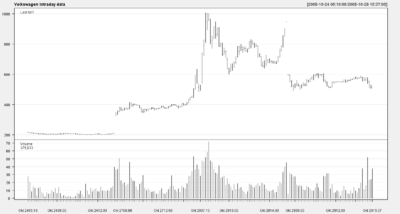

[11] In October 2008, a short squeeze triggered by an attempted takeover by Porsche temporarily drove the shares of Volkswagen AG on the Xetra DAX from €210.85 to over €1000 in less than two days, briefly making it the most valuable company in the world.

[14][15] In 2012, the U.S. Securities and Exchange Commission charged Philip Falcone with market manipulation in relation to a short squeeze on a series of high-yield bonds issued by MAAX Holdings.

[17] In November 2015, Martin Shkreli orchestrated a short squeeze on failed biotech KaloBios (KBIO) that caused its share price to rise by 10,000% in just five trading days.