Network effect

Network effects are commonly mistaken for economies of scale, which describe decreasing average production costs in relation to the total volume of units produced.

Network effects are the demand side counterpart of economies of scale, as they function by increasing a customer's willingness to pay due rather than decreasing the supplier's average cost.

In selling the product, Metcalfe argued that customers needed Ethernet cards to grow above a certain critical mass if they were to reap the benefits of their network.

[7] The economic theory of the network effect was advanced significantly between 1985 and 1995 by researchers Michael L. Katz, Carl Shapiro, Joseph Farrell, and Garth Saloner.

[11] The next major advance occurred between 2000 and 2003 when researchers Geoffrey G Parker, Marshall Van Alstyne,[12][non-primary source needed] Jean-Charles Rochet and Jean Tirole[13][non-primary source needed] independently developed the two-sided market literature showing how network externalities that cross distinct groups can lead to free pricing for one of those groups.

Another major finding was the dramatic increase in the infant mortality rate of websites — with the dominant players in each functional niche - once established guarding their turf more staunchly than ever.

But due to network economics, the more industries are involved in creating such products, the easier it is to design an environmentally sustainable building.

This creates a risk that customers will defect to a rival network because of the inadequate capacity of the existing system.

The P2P based telephony service Skype benefits from this effect and its growth is limited primarily by market saturation.

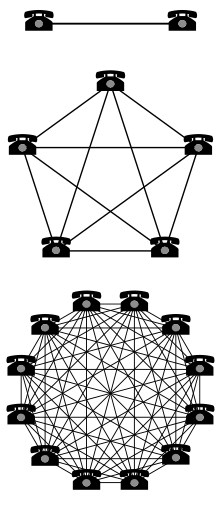

[20] Network effects give rise to the potential outcome of market tipping, defined as "the tendency of one system to pull away from its rivals in popularity once it has gained an initial edge".

[2] If some existing technology or company whose benefits are largely based on network effects starts to lose market share against a challenger such as a disruptive technology or open standards based competition, the benefits of network effects will reduce for the incumbent, and increase for the challenger.

[32] Product compatibility is closely related to network externalities in company's competition, which refers to two systems that can be operated together without changing.

As the supplier of Windows systems, Microsoft benefits from indirect network effects, which cause the growing of the company's market share.

Because incompatibility of products will aggravate market segmentation and reduce efficiency, and also harm consumer interests and enhance competition.

In communication and information technologies, open standards and interfaces are often developed through the participation of multiple companies and are usually perceived to provide mutual benefit.

One observed method Microsoft uses to put the network effect to its advantage is called Embrace, extend and extinguish.

According to Michael E. Porter, strong network effect might decrease the threat of new entrants, which is one of the five major competitive forces that act on an industry.

[39] These attractive characteristics are one of the reasons that allowed platform companies like Amazon, Google or Facebook to grow rapidly and create shareholder value.

This often leads to increased scrutiny from regulators that try to restore healthy competition, as is often the case with large technology companies.

Eventually increased usage through exponential growth led to the telephone is used by almost every household adding more value to the network for all users.

Similarly, the Chicago Mercantile Exchange has maintained dominance in trading of Eurobond interest rate futures despite a challenge from Euronext.Liffe.

The software-purchase characteristic is that it is easily influenced by the opinions of others, so the customer base of the software is the key to realizing a positive network effect.

This enables the software to grow in popularity very quickly and spread to a large userbase with very limited marketing needed.

The Freemium business model has evolved to take advantage of these network effects by releasing a free version that will not limit the adoption or any users and then charge for premium features as the primary source of revenue.

[49] By doing so, they intentionally stimulate the network effect - as more students learn to use a particular piece of software, it becomes more viable for companies and employers to use it as well.

Essentially, as the number of users of eBay grows, prices fall and supply increases, and more and more people find the site to be useful.

Thus, the service appears to aim to serve as an exchange (or ad network) for matching many advertisers with many small sites.

For credit cards that are now widely used, large-scale applications on the market are closely related to network effects.

Later, credit cards gradually entered the network level due to changes in policy priorities and became a popular trend in payment in the 1980s.

[53] Visa has become a leader in the electronic payment industry through the network effect of credit cards as its competitive advantage.