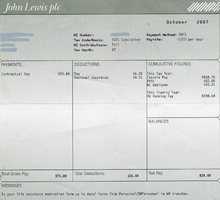

Paycheck

In recent times, the physical paycheck has been increasingly replaced by electronic direct deposits to the employee's designated bank account or loaded onto a payroll card.

In most countries with a developed wire transfer system, payment of wages and salaries is increasingly being effected by electronic means, rather than by the use of a physical cheque.

Most of the provinces and territories in Canada allow employers to issue electronic payslips if the employees have confidential access to it and are able to print it.

[1] A payroll card is typically less convenient than cashing a paper paycheck, because the card can be used at participating automatic teller machines to withdraw cash (which usually requires the employee to pay a hefty fee to access their own money and always have daily limits for how much of their own money an employee can access daily) or in stores to make purchases.

According to Visa, it costs an employer about 35 cents to issue pay electronically but two dollars to write a paper paycheck.