Payment card

The largest global card payment organizations are: UnionPay, Visa, Mastercard and American Express.

These are able to perform banking tasks at ATMs and also make point-of-sale transactions, with both features using a PIN.

Canada's Interac and Europe's Debit Mastercard are examples of networks that link bank accounts with point-of-sale equipment.

The cardholder can either repay the full outstanding balance or a lesser amount by the payment due date.

What is called a credit card in the United States - meaning the customer has a bill to pay at the end of the month - does not exist in the French banking system.

In this case, the consumer decides the maximum amount, making it impossible to fall into debt by forgetting to pay a credit card bill.

Personal information cannot be shared among banks, which means there is no centralized system for tracking creditworthiness.

The only centralized system in France is for individuals who file for bankruptcy or those who have not repaid credit or issued checks without sufficient funds.

[10][11] The use of debit cards has become widespread in many countries and has overtaken use of cheques, and in some instances cash transactions, by volume.

With charge cards, the cardholder is required to pay the full balance shown on the statement, which is usually issued monthly, by the payment due date.

An ATM card (known under a number of names) is any card that can be used in automated teller machines (ATMs) for transactions such as deposits, cash withdrawals, obtaining account information, and other types of transactions, often through interbank networks.

For other types of transactions through telephone or online banking, this may be performed with an ATM card without in-person authentication.

[12][13] These terminals can also be used as cashless scrip ATMs by cashing the receipts they issue at the merchant's point of sale.

The elimination of cash also helps to prevent fraudulent transactions at the fleet owner's or manager's expense.

Fleet cards provide convenient and comprehensive reporting, enabling fleet owners/managers to receive real time reports and set purchase controls with their cards, helping to keep them informed of all business related expenses.

They may also reduce administrative work or otherwise be essential in arranging fuel taxation refunds.

Other types of payment cards include: A number of International Organization for Standardization standards, ISO/IEC 7810, ISO/IEC 7811, ISO/IEC 7812, ISO/IEC 7813, ISO 8583, and ISO/IEC 4909, define the physical properties of payment cards, including size, flexibility, location of the magstripe, magnetic characteristics, and data formats.

Though the imprinting method has been predominantly superseded by the magnetic stripe and then by the integrated chip, cards continued to be embossed in case a transaction needs to be processed manually until recently.

Using smart cards is also a form of strong security authentication for single sign-on within large companies and organizations.

Proximity cards are powered by resonant energy transfer and have a range of 0–3 inches in most instances.

Re-programmable/dynamic magnetic stripe cards are standard sized transaction cards that include a battery, a processor, and a means (inductive coupling or otherwise) of sending a variable signal to a magnetic stripe reader.

[19] Due to increased illegal copies of cards with a magnetic stripe, the European Payments Council established a Card Fraud Prevention Task Force in 2003 that spawned a commitment to migrate all ATMs and POS applications to use a chip-and-PIN solution until the end of 2010.

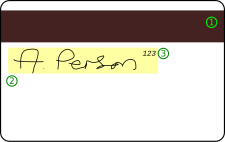

- Issuing bank logo

- EMV chip

- Hologram

- Card number

- Card brand logo

- Expiration date

- Cardholder's name