Peak oil

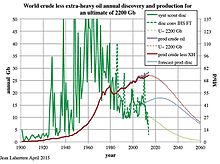

[6][8] Over the last century, many predictions of peak oil timing have been made, often later proven incorrect due to increased extraction rates.

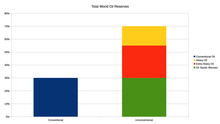

As a result of the wide range of potential definitions, different oil production forecasts may vary based on which classes of liquids they choose to include or exclude.

[53] With rule changes by the SEC,[54] oil companies can now book them as proven reserves after opening a strip mine or thermal facility for extraction.

These unconventional sources are more labor and resource intensive to produce, however, requiring extra energy to refine, resulting in higher production costs and up to three times more greenhouse gas emissions per barrel (or barrel equivalent) on a "well to tank" basis or 10 to 45% more on a "well to wheels" basis, which includes the carbon emitted from combustion of the final product.

[61] Chuck Masters of the USGS estimates that, "Taken together, these resource occurrences, in the Western Hemisphere, are approximately equal to the Identified Reserves of conventional crude oil accredited to the Middle East.

[55][65] The same applies to much of the Middle East's undeveloped conventional oil reserves, much of which is heavy, viscous, and contaminated with sulfur and metals to the point of being unusable.

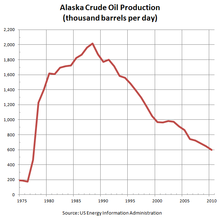

In 2019 when Saudi Aramco went public, the Ghawar oilfield, which is the largest oil field in the world, was revealed to be producing much lower than what conventional wisdom at the time had assumed its production was.

According to the US EIA in 2006, Saudi Aramco Senior Vice President Abdullah Saif estimated that its existing fields were declining at a rate of 5% to 12% per year.

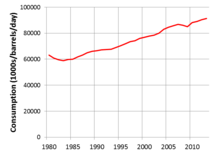

Enverus forecasts global oil demand to reach 108 million barrels per day by 2030, driven by slower improvements in fuel economy and electric vehicle adoption in the U.S.

[93] Some analysts argue that the cost of oil has a profound effect on economic growth due to its pivotal role in the extraction of resources and the processing, manufacturing, and transportation of goods.

[98] The wide use of fossil fuels has been one of the most important stimuli of economic growth and prosperity since the Industrial Revolution,[99] allowing humans to participate in takedown, or the consumption of energy at a greater rate than it is being replaced.

Some theorize that when oil production significantly decreases, human culture and modern technological society will be forced to change drastically.

[104] Alternatives such as electric aircraft show promise, but are yet to prove commercially viable as of 2024,[105] while hybrids approaches such as a 50% blend of aviation biofuel or utilising metal sails on cargo ships[106] still rely on oil.

The specific fossil fuel input to fertilizer production is primarily natural gas, to provide hydrogen via steam reforming.

[109] In 2005, the United States Department of Energy published a report titled Peaking of World Oil Production: Impacts, Mitigation, & Risk Management.

Such a system could include a tax shifting from income to depleting natural resources (and pollution), as well as the limitation of advertising that stimulates demand and population growth.

Permaculture sees peak oil as holding tremendous potential for positive change, assuming countries act with foresight.

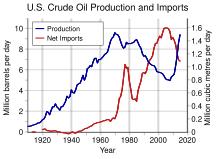

In 1919, David White, chief geologist of the United States Geological Survey, wrote of US petroleum: "... the peak of production will soon be passed, possibly within 3 years.

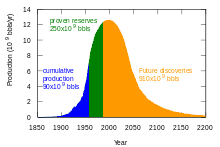

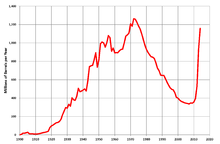

He wrote: "But if the curve is made to look reasonable, it is quite possible to adapt mathematical expressions to it and to determine, in this way, the peak dates corresponding to various ultimate recoverable reserve numbers"[120] By observing past discoveries and production levels, and predicting future discovery trends, the geoscientist M. King Hubbert used statistical modelling in 1956 to predict that United States oil production would peak between 1965 and 1971.

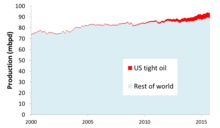

[121] While this prediction held for many decades,[122] more recently as of 2018 daily oil production in the United States had finally exceeded its previous peak in 1970.

Depending on the limits of exploitability and market pressures, the rise or decline of resource production over time might be sharper or more stable, appear more linear or curved.

A comprehensive 2009 study of oil depletion by the UK Energy Research Centre noted:[126] Few analysts now adhere to a symmetrical bell-shaped production curve.

[138][139] In 2015, analysts in the petroleum and financial industries claimed that the "age of oil" had already reached a new stage where the excess supply that appeared in late 2014 may continue.

[146] John Hofmeister, president of Royal Dutch Shell's US operations, while agreeing that conventional oil production would soon start to decline, criticized the analysis of peak oil theory by Matthew Simmons for being "overly focused on a single country: Saudi Arabia, the world's largest exporter and OPEC swing producer.

"[147] Hofmeister pointed to the large reserves at the US outer continental shelf, which held an estimated 100 billion barrels (16×10^9 m3) of oil and natural gas.

Environmentalists argue that major environmental, social, and economic obstacles would make extracting oil from these areas excessively difficult.

Physical peak oil, which I have no reason to accept as a valid statement either on theoretical, scientific or ideological grounds, would be insensitive to prices. ...

In 2008, Daniel Yergin of CERA suggest that a recent high price phase might add to a future demise of the oil industry, not of complete exhaustion of resources or an apocalyptic shock but the timely and smooth setup of alternatives.

"[154] Environmental journalist George Monbiot responded to a 2012 report by Leonardo Maugeri[155] by suggesting that there is more than enough oil (from unconventional sources) to "deep-fry" the world with climate change.

[156] Stephen Sorrell, senior lecturer Science and Technology Policy Research, Sussex Energy Group, and lead author of the UKERC Global Oil Depletion report, and Christophe McGlade, doctoral researcher at the UCL Energy Institute have criticized Maugeri's assumptions about decline rates.

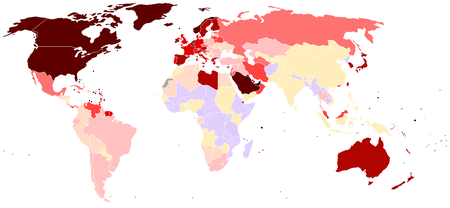

|

> 0.07

0.07–0.05 0.05–0.035 0.035–0.025 0.025–0.02 |

0.02–0.015

0.015–0.01 0.01–0.005 0.005–0.0015 < 0.0015 |