Pensions crisis

[4] One aspect and challenge of the "Pension timebomb" is that several countries' governments have a constitutional obligation to provide public services to its citizens, but the funding of these programs, such as healthcare are at a lack of funding, especially after the 2008 recession and the strain caused on the dependency ratio by an ageing population and a shrinking workforce, which increases costs of elderly care.

In other words, this amount would have to be set aside today so that the principal and interest would cover the program's shortfall between tax revenues and payouts over the next 75 years.

This is due to two demographic factors: increased life expectancy coupled with a fixed retirement age, and a decrease in the fertility rate.

[10] Examples of support ratios for selected countries and regions in 1970, 2010, and projected for 2050 using the medium variant:[11] Pension computations are often performed by actuaries using assumptions regarding current and future demographics, life expectancy, investment returns, levels of contributions or taxation, and payouts to beneficiaries, among other variables.

Critics have argued that investment return assumptions are artificially inflated, to reduce the required contribution amounts by individuals and governments paying into the pension system.

If these rates were lowered by 1–2 percentage points, the required pension contributions taken from salaries or via taxation would increase dramatically.

[13] The International Monetary Fund reported in April 2012 that developed countries may be underestimating the impact of longevity on their public and private pension calculations.

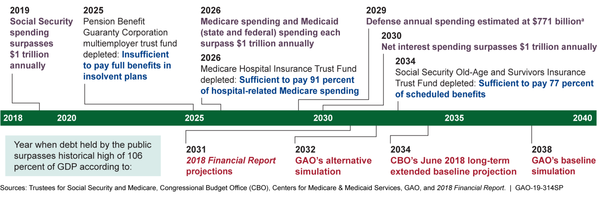

[14] The Pension Benefit Guaranty Corporation's (PBGC) financial future is uncertain because of long-term challenges related to its funding and governance structure.

[19] Since 2001, the financial health of state and local retirement systems have struggled to recover from the historic economic downturns of the Dot-Com Crash, Great Recession and the Covid-19 Pandemic.

Conversely, Nebraska, Utah, New York and Idaho's retirement systems represent a negligible impact to their states' economic demands, as they have been able to maintain fully-funded status.

[24] The Congressional Budget Office reported in May 2011 that "most state and local pension plans probably will have sufficient assets, earnings, and contributions to pay scheduled benefits for a number of years and thus will not need to address their funding shortfalls immediately.

[27] The term unfunded liability represents the amount of money that would have to be set aside today such that interest and principal would cover the gap between program cash inflows and outflows over a long period of time.

Most public pension unfunded liabilities reside within statewide retirement systems, primarily because they are simply larger, with more members and more promised benefits.

Locally-managed public pension plans account for approximately 12% of all unfunded liabilities of non-federal retirement systems.

The Social Security Administration reported in 2009 that there is a long-term trend of pensions switching from defined benefit (DB) (i.e., a lifetime annuity typically based on years of service and final salary) to defined contribution (DC) (e.g., 401(k) plans, where the worker invests a certain amount, often with a match from the employer, and can access the money upon retirement or under special conditions.)

"[30] The percentage of workers covered by a traditional defined benefit (DB) pension plan declined steadily from 38% in 1980 to 20% in 2008.

In contrast, the percentage of workers covered by a defined contribution (DC) pension plan has been increasing over time.

Employers took advantage of the switch to surreptitiously cut benefits; investment returns have been far lower than workers were told to expect; and, to be fair, many people haven't managed their money wisely.

[34] Fidelity Investments reported in February 2014 that: Due to the low savings ratio, rapidly increasing longevity, new taxation of pension funds (for instance the removal of the right to reclaim withholding tax on equity dividends), and above all falling investment returns, many pension funds are in difficulties in the early 21st century.

In October 2017 the UK Government implemented a mandatory automatic enrolment system where full-time employees and employers have to make contributions to a workplace pension scheme.

These changes were driven by demographic shifts, including increased life expectancy and the declining worker-to-retiree support ratio.

[38][39] The WASPI campaign argues that women born in the 1950s were not properly informed about significant changes to their pension entitlements.

As of 2023, the WASPI campaign continues to seek compensation and recognition for the women affected by these pension age changes.

[44][45] From then Jyrki Katainen (2011-2014), Alexander Stubb (2014-2015), Juha Sipilä (2015-2019), Antti Rinne (2019) and the Marin governments (2019-) have tried to overhaul the social and healthcare system (Sote-law) that includes both structural reforms but also answers and solutions to the increased strain on Finland's public services by the ageing population, as it has constitutional problems: the government and municipalities are constitutionally obliged to provide healthcare and social services to its citizens, but several smaller municipalities lack funding due to a dried taxpayer base and an ageing population.

[43][44][45] In his book titled The Pension Fund Revolution (1996), Peter Drucker point out the theoretical difficulty of a solution, and proposed a second best policy that may be enable to enforce.

Auto-Enrolment schemes are easier to implement because employees are enrolled but have the option to drop out, as opposed to being required to take action to opt into the plan or being legally compelled to participate.

Most countries that launched mandatory or auto-enrolment schemes did so with the intention of employees saving into defined contribution ("DC") plans.

Following the UK's successful by introducing Automatic enrolment in 2012 based upon behavioural economic theory[49] the Department for Work & Pensions has now proposed new legislation which enables the creation of risk-sharing decumulation solutions such as Collective Defined Contribution schemes and Tontine pension schemes the latter of which also benefits from behavioural economic effects according to Adam Smith in his book The Wealth of Nations.