Profit (economics)

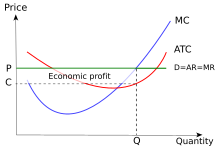

[5] Companies do not make any economic profits in a perfectly competitive market once it has reached a long run equilibrium.

If an economic profit was available, there would be an incentive for new firms to enter the industry, aided by a lack of barriers to entry, until it no longer existed.

Furthermore, these intruders are forced to offer their product at a lower price to entice consumers to buy the additional supply they have created and to compete with the incumbent firms (see Monopoly profit § Persistence).

[7][8][9][10] As the incumbent firms within the industry face losing their existing customers to the new entrants,[11] they are also forced to reduce their prices.

[7][8][9] The same is likewise true of the long run equilibria of monopolistically competitive industries, and more generally any market which is held to be contestable.

Normally, a firm that introduces a differentiated product can initially secure temporary market power for a short while (See Monopoly Profit § Persistence).

When this finally occurs, all economic profit associated with producing and selling the product disappears, and the initial monopoly turns into a competitive industry.

Once risk is accounted for, long-lasting economic profit in a competitive market is thus viewed as the result of constant cost-cutting and performance improvement ahead of industry competitors, allowing costs to be below the market-set price.

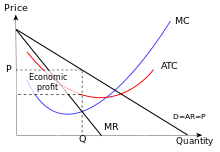

Economic profit is much more prevalent in uncompetitive markets such as in a perfect monopoly or oligopoly situation, where few substitutes exit.

[14] These barriers allow firms to maintain a large portion of market share due to new entrants being unable to obtain the necessary requirements or pay the initial costs of entry.

In an oligopoly, firms are able to collude and limit production, thereby restricting supply and maintaining a constant economic profit.

[7][10][2] An extreme case of an uncompetitive market is a monopoly, where only one firm has the ability to supply a good which has no close substitutes.

The existence of uncompetitive markets puts consumers at risk of paying substantially higher prices for lower quality products.

After a successful appeal on technical grounds, Microsoft agreed to a settlement with the Department of Justice in which they were faced with stringent oversight procedures and explicit requirements[18] designed to prevent this predatory behaviour.

On the other hand, if a government feels it is impractical to have a competitive market—such as in the case of a natural monopoly—it will allow a monopolistic market to occur.

[8][9] For example, the old AT&T (regulated) monopoly, which existed before the courts ordered its breakup, had to get government approval to raise its prices.

[9] It is a standard economic assumption (although not necessarily a perfect one in the real world) that, other things being equal, a firm will attempt to maximize its profits.

For the supply side of economics, the general school of thought is that profit is meant to ensure shareholder yield.